A tool designed for building professionals to help prepare top level cost plans, provide early cost advice to clients and benchmark costs for both commercial and residential buildings

Published: 16/09/2022

The early estimate for tender price inflation from the BCIS All-in Tender Price Index (TPI) shows a 1.5% increase between 2Q2022 and 3Q2022.

The resultant 3Q2022 TPI figure shows an increase of 8% in the year from 3Q2021¹.

This estimate is the consensus of the BCIS TPI Panel² based on the analysed Delphi survey results. It does not necessarily represent the views of individual participants.

The range of responses on the tender price movement question narrowed significantly compared to the previous quarter, with the average estimated at 1.5%.

Very few panellists reported differential in price movement between the regions, size, sectors, building work and M&E. However, almost half reported differential movement between procurement routes.

Two stage procurement was reported to command premiums. Whereas single stage procurement to deliver competitive pricing.

Prices of materials continue to increase, with fuel and energy prices having the largest impact.

Prices for imported European goods continue to escalate and affect trade pricing.

Steelwork and reinforcement prices that had been rising sharply during the past quarters are now softening.

The Panel agreed that contractors are more able to manage tender price inflation by pre-ordering materials which is resulting in earlier requests for information.

The panel reported Overheads and Profit at 5.5%, slightly up from 5.2% last quarter.

With basic costs rising faster than tenders, this would suggest some reduction in prices from suppliers and sub-contractors.

There is a clear lack of confidence in the market, with contractors balancing the potential for UK recession with the fact that the construction industry has reasonable workload and is under-resourced.

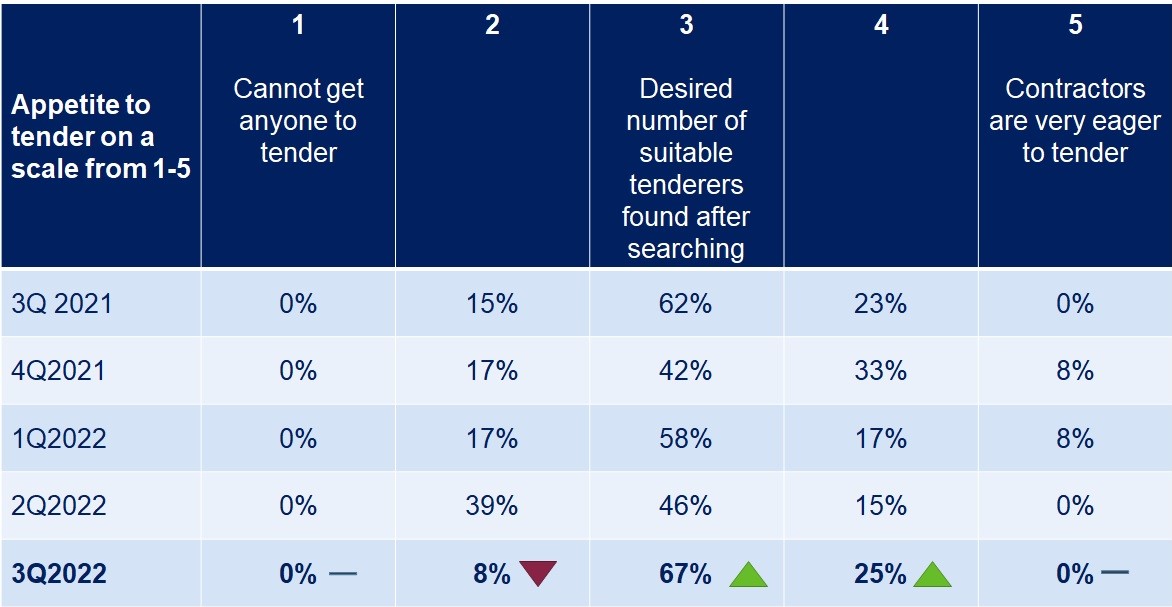

The panel reported an increased appetite to tender in the quarter.

BCIS TPI Panel – Appetite to tender

Source: BCIS

Moving forward, the possibility of an economic recession, price fixity and increased strike action, together with pressure on wage levels, are expected to remain main concerns and factors that will affect tender price inflation.

¹ Note: the BCIS TPI Panel estimate has been applied to the previous quarter index and rounded to the nearest whole number for publication.

² The BCIS TPI Panel. BCIS has recruited a panel of practicing cost consultants from firms involved in multiple tenders in each quarter to provide an early estimate of tender price movement in the latest quarter based on a panel (Delphi) survey approach. For further details see: BCIS tender price index panel.

Basis of BCIS Tender Price Index. TPI figures prior to 4th quarter 2018 are based on project indices, generally single stage, traditional procurement, average value < £5million, (minimum £100,000, no maximum). Excludes M+E and other specialist trades, e.g. facades. BCIS has assumed this reflects market projects let on single stage Design and Build and Specification and Drawings. Indices are normalised for location, size and procurement. Percentage changes are mid-quarter to mid-quarter.

The current BCIS TPI Panel members are:

- Adam Reeve, Calfordseaden

- Anjni Varsani, Gardiner & Theobald

- David Happell, Exigere

- Don Patterson, Equals Consulting

- Gavin Margatroyd, Gardiner & Theobald

- Ian Aldous, Mace Group

- James Garner, Gleeds

- Kristoffer Hudson, Turner & Townsend

- Mark Lacey, Alinea

- Max Wilkes, F+G

- Michael Urie, Gardiner & Theobald

- Nicola Sharkey, Gleeds

- Nigel Hawes, Exigere

- Peter Maguire, WT Partnership

- Rachel Coleman, Alinea

- Richard Hill, Currie and Brown

- Roger Hogg, Rider Levett Bucknall

- Simon Cash, Artelia

- Simon Rawlinson, Arcadis

- Steve Waltho, Turner & Townsend

- Stuart Wigley, Baily Garner