The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 10/06/2025

The clock’s ticking on the UK-US tariff deal. Up to four weeks of negotiations are the only buffer against a potential 50% tariff on UK steel exports. International US import tariffs are already weakening construction demand, evident in the UK construction’s output, which continues to flatline amid prevailing uncertainty.

Either way the deal’s outcome will bring negatives, but with a stagnant economy and long-term prosperity for construction looking doubtful, a no tariff outcome seems the best path forward – for the future of UK steel and construction’s decarbonisation at the very least.

Tariff turmoil to date

Trump’s tariff terms move quickly. While discussions between the US and UK simmer in the background, global frustrations are heating up after Trump enforced a 50% tariff on imported steel and aluminium goods on Wednesday (4 June). Mexico has promised countermeasures while Trump and Xi Jinping continue talks in a bid to resolve trade war tensions.

It’s still early days to understand the long-term economic impact of tariff turmoil, but the latest insight from the Organisation for Economic Co-operation and Development (OECD) points to a less-than-positive outlook for the UK. In its latest economic outlook, released in June, the OECD marginally downgraded its expectations for the UK’s economy, forecasting 1.3% growth in 2025 (down from 1.4%), and 1.0% growth in 2026 (down from 1.2%)(1).

In contrast, the Office for Budget Responsibility’s (OBR) latest forecast in March projected UK GDP would grow to 1.9% in 2026 and, while this did not account for tariff uncertainty, the ramifications of escalating global trade disputes were further underlined. In its executive summary, the OBR said that should disputes ramp up to include 20 percentage-point rises in tariffs between the US and the rest of the world, UK GDP could drop by a peak of 1.0%, and reduce the current surplus in the target year to almost zero(2).

Given construction’s inextricable link with wider economic health, these forecasts bring little comfort. Already, trade strife has been reflected in demand and output insights to some extent. Construction output flatlined in 1Q2025 and new insight from S&P Global’s latest construction PMI saw a continued decline in activity. Survey respondents of the latter also cited subdued demand conditions and delayed decision-making among clients as key challenges.

Furthermore, a member of the BCIS Tender Price Index panel reported an instance of a ‘high risk premium’ being added to project costs relating to imports from the US in the latest quarter, purely to account for the current uncertainty.

It follows that continued uncertainty, which the tariff battles are no doubt fuelling, is hampering investor confidence and construction’s recovery. Yet reaching a no tariff deal goes beyond remedying this alone. Even in the smallest of ways, it could halt the UK’s accelerating reliance on steel imports and help secure the construction sector’s ability to decarbonise.

The great steel dependency

All things considered, the actual outcome of the tariff deal bears little influence on UK construction.

In the short term, hiking the UK tariff to 50% could actually bring some benefits for the sector. In this scenario, UK steel and aluminium exports are likely to fall, which would initially increase domestic supply and lead to lower costs for these goods as suppliers compete with overseas imports and look to sell their excess.

With other international steel exporters now seeking non-US markets, it’s likely a UK tariff would lend itself to the ‘dumping’ of goods and a reduction in domestic steel prices. While bad news for UK steel producers, this shift would mean less cost for contractors and their clients.

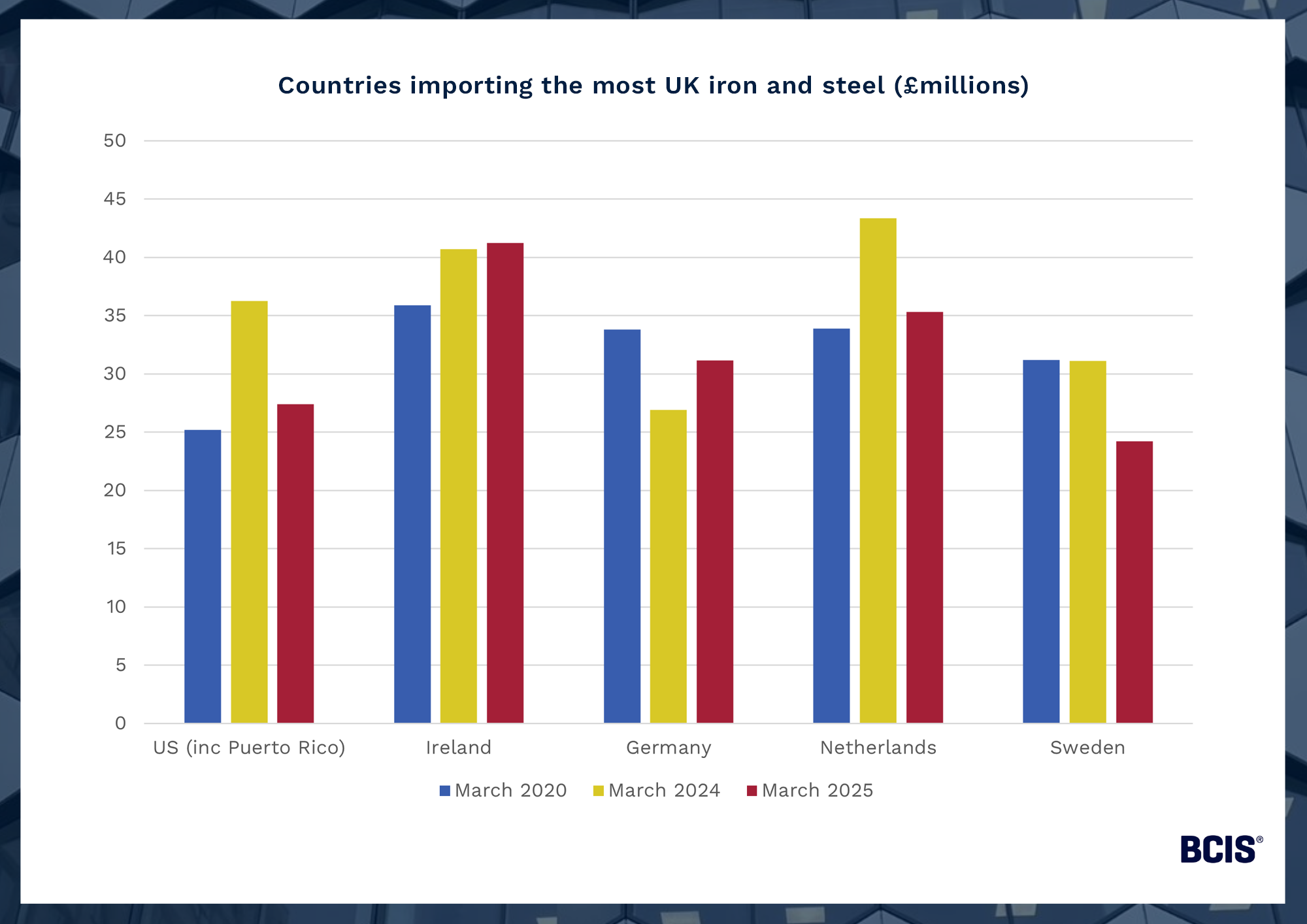

That said, removing the UK tariff seems the slightly more fruitful route. The benefits for the UK steel industry are clear with the US consistently among the countries importing the most UK iron and steel(3).

Source: ONS

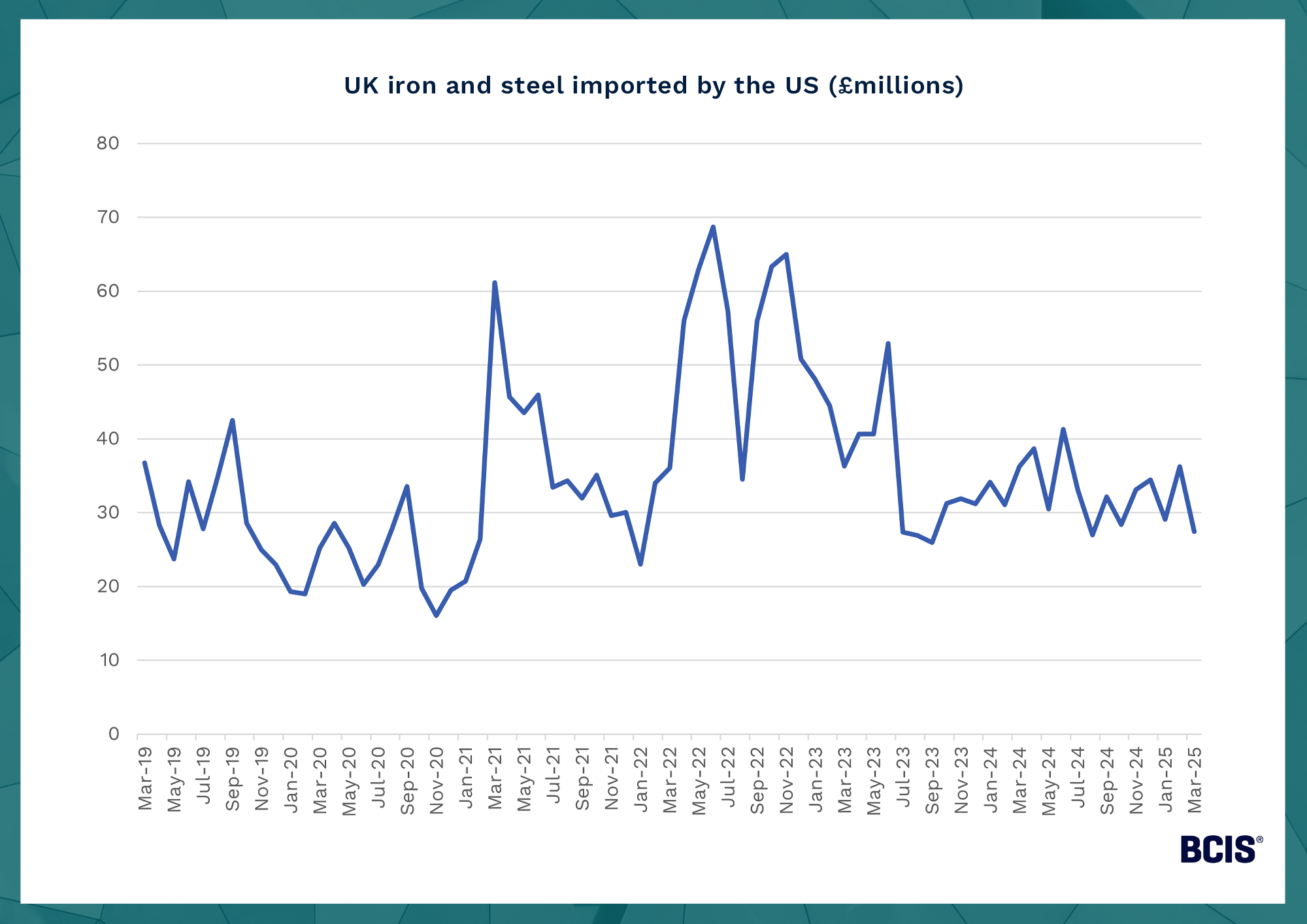

Since 12 March, the UK has faced a 25% tariff on all steel and aluminium products. In March 2025, US imports of UK steel and iron fell by 24.5% on the year and 25.4% on pre-pandemic March 2019(4). While it’s impossible to link this data directly to the tariff, it seems plausible the tariff played a role in the recent decline of these goods being imported by the US.

Source: ONS

Europe’s reaction to Trump’s 50% tariff is also a warning for the security of domestic steel ahead of a potential no deal in the UK. Last week, Ilse Henne, chief executive of ThyssenKrupp Materials Services, agreed that European steel faced a ‘wipeout’, which could cause high collateral damage and a greater reliance on the US and China(5).

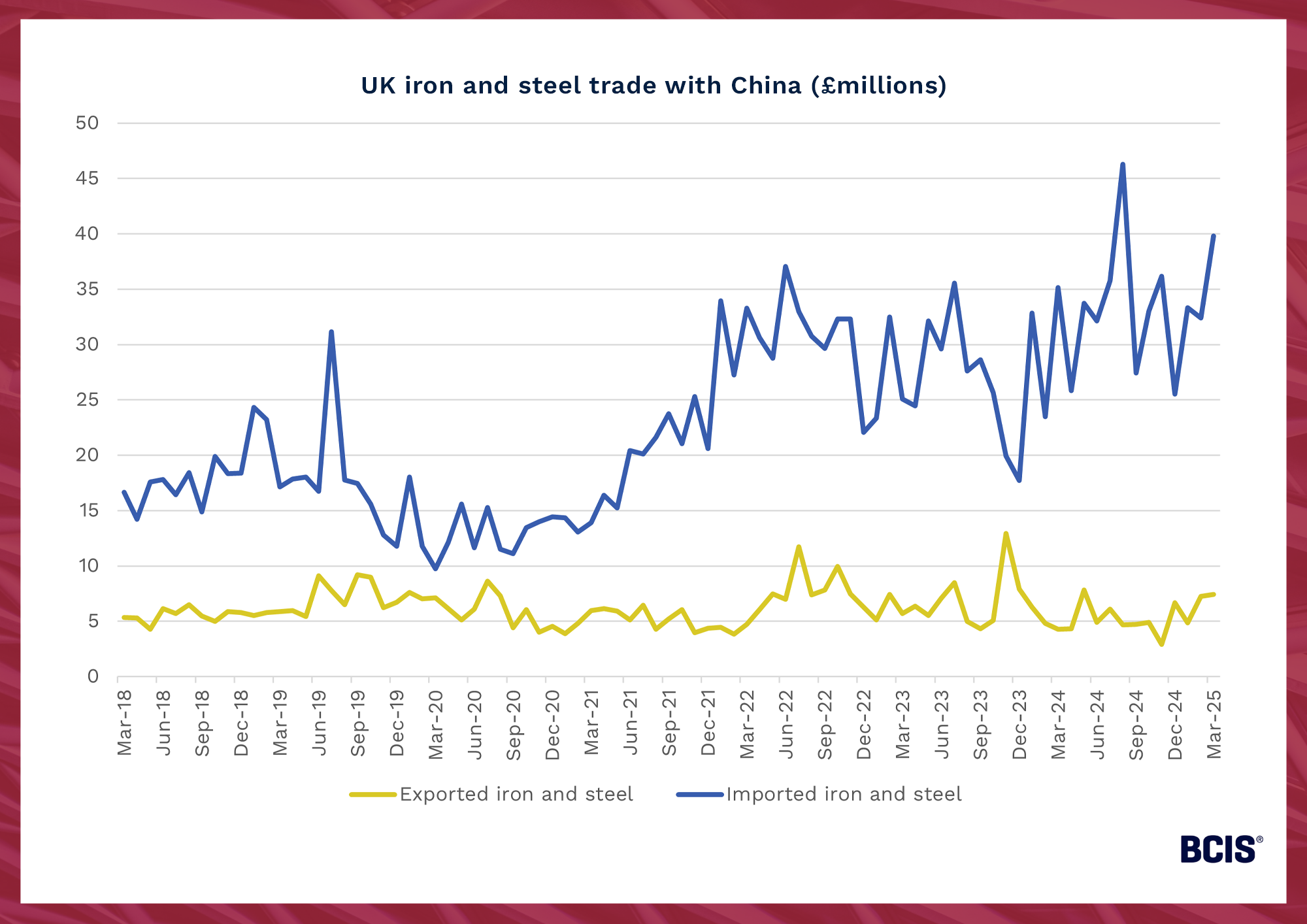

For the past five years, UK dependency on steel imports from China has grown exponentially and a higher tariff could skyrocket this reliance further. At a time of high costs, the cheaper steel Chinese suppliers can offer is incredibly attractive to construction businesses working with tight budgets.

For the UK construction sector, this would bring opportunity and risk; opportunity in cheaper steel prices, but risk in the greater exposure to cost fluctuations of global markets, beyond businesses’ control.

Source: ONS

In March 2025, steel imports from China were up by 13.2% on the year and by 132% on pre-pandemic March 2019(6). It’s likely that further dumping of cheaper steel by international suppliers will only increase UK reliance on imports as domestic suppliers struggle to survive and offer more competitive prices.

No deal, no green progress?

On some level, failure to secure the UK-US tariff deal would be a setback for construction’s decarbonisation too.

China is taking steps to reduce the footprint of its steel production – chiefly by requiring producers to buy carbon emissions allowances when they hit a benchmark – but the nation is still far from being a haven for green steel. Finnish nonprofit CREA has estimated that China generates over two tonnes of carbon dioxide for every tonne of steel it produces – slightly higher than the global average (1.91 tCO2/t)(7).

In light of the joint investment between the government and Tata Steel in state-of-the-art electric arc furnace steelmaking, increasing the UK’s reliance on Chinese steel imports could derail the green steel transition. Steel is a key material in construction and making its production more sustainable is important for reducing embodied carbon emissions in new work.

However, the UK’s energy costs are among the highest in the world and until this changes, domestic steel production will remain uncompetitive and imports more cost-effective.

To this end, the outcome of the UK’s deal or no deal dilemma will have minimal bearing on the construction sector in the short term.

But for the sake of domestic steel and moving construction’s carbon progress forward, let’s hope the UK falls in Trump’s good books.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) OECD Economic Outlook, Volume 2025 Issue 1 – Tackling Uncertainty, Reviving Growth - here

(2) Office for Budget Responsibility – Economic and fiscal outlook – March 2025 - here

(3) Office for National Statistics – Dataset – Trade in goods: country-by-commodity exports - here

(4) Office for National Statistics – Dataset – Trade in goods: country-by-commodity exports - here

(5) The Guardian – Trump tariffs could wipe out European steel sector, senior industry figure says - here

(6) Office for National Statistics – Dataset – Trade in goods: country-by-commodity import - here

(7) CREA – Steel sector decarbonisation in China stalls, with investments in coal-based steel plants since 2021 exceeding USD 100 billion despite overcapacity and climate goals - here