The full forecast and commentary are published in the Briefing section of the Civil Engineering Trends and Forecasts online

Published: 27/10/2022

BCIS have released their latest 5-year Civil Engineering Forecasts.

The construction tendering process is expected to experience increased pressure during the current turbulent climate. The slowdown in the economy will encourage contractors to ensure their future order books, while inflationary pressures bring risks to longer term commitments; it will require flexibility from all parties to deliver successful outcomes.

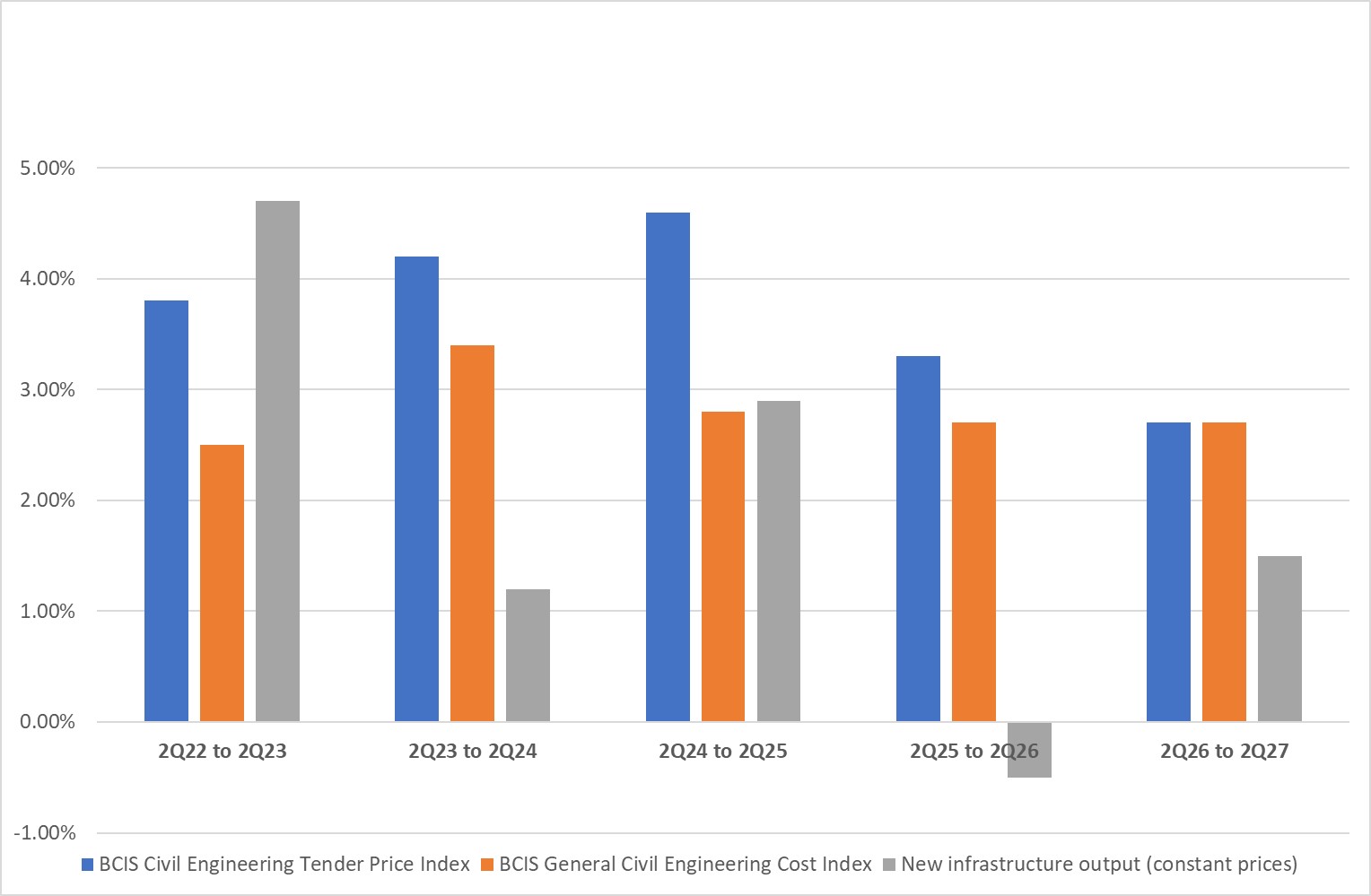

The BCIS forecasts for the next five years:

- Civil engineering costs +15% (2Q2022-2Q2027)

- Civil engineering tender prices +20% (2Q22-2Q2027)

- Infrastructure new work output +10% (2021-2026)

While there is likely to be a recession in the economy, the government has previously committed to infrastructure investment as a lever for economic growth.

Output from the infrastructure sector reached unprecedented heights in 2021 but in the first six months of 2022 there has been a decline in most sectors. However, relatively strong output in the significant Roads and Railways sectors has seen overall output hold up. Infrastructure construction output is forecast to rise by 4.7% in 2022 and by 1.2% in 2023.

Civil engineering materials prices rose by 11.2% in 2Q2022 compared with the previous quarter, and by 26.8% compared with a year earlier. Over the year there were double-digit increases in all materials with particular sharp rises in the cost of oil, timber and steel. Rise in the cost of oil was exacerbated by the removal of the red diesel rebate from April 2022; this had a significant effect on plant costs in this period. The main risks to materials prices continue to be difficulty in obtaining materials, volatile energy prices, tariffs on imports and sterling exchange rates.

The Hays/BCIS Site Wage Cost Index: All-in shows the annual inflation in site rates of 12.2% in 2Q2022, whereas the BCIS Civil Engineering Labour cost index, which reflects nationally agreed wage awards rose by 3.0% over the same period. Labour shortages are causing an intense pressure on the national wage negotiating bodies to reflect the underlying double-digit inflation in their settlements. Wage awards are expected to average 4.9% in 2023 and 7.4% in 2024, settling down to around 2.5% for the remainder of the forecast period. The cost and availability of labour is anticipated to be the major barrier to the delivery of infrastructure projects over the next year.

Civil engineering costs rose by 9.2% in 2Q2022 compared with the previous quarter, and by 18.2% compared with a year earlier. Costs will rise by 15% over the forecast period (2Q2022 to 2Q2027).

Civil engineering tender prices in 2Q2022 rose by 4.6% compared with the previous quarter and by 9.6% on an annual basis. Civil engineering tender prices will rise by 20% over the forecast period (2Q2022 to 2Q2027), with infrastructure output remaining at a historically high level.

Figure 1: Civil Engineering Tender Prices, Input Costs and New Work Infrastructure Output

Source: BCIS

(Annual percentage change: Prices and Costs 2Q to 2Q, output whole year on whole year*)