A tool designed for building professionals to help prepare top level cost plans, provide early cost advice to clients and benchmark costs for both commercial and residential buildings

Published: 06/06/2022

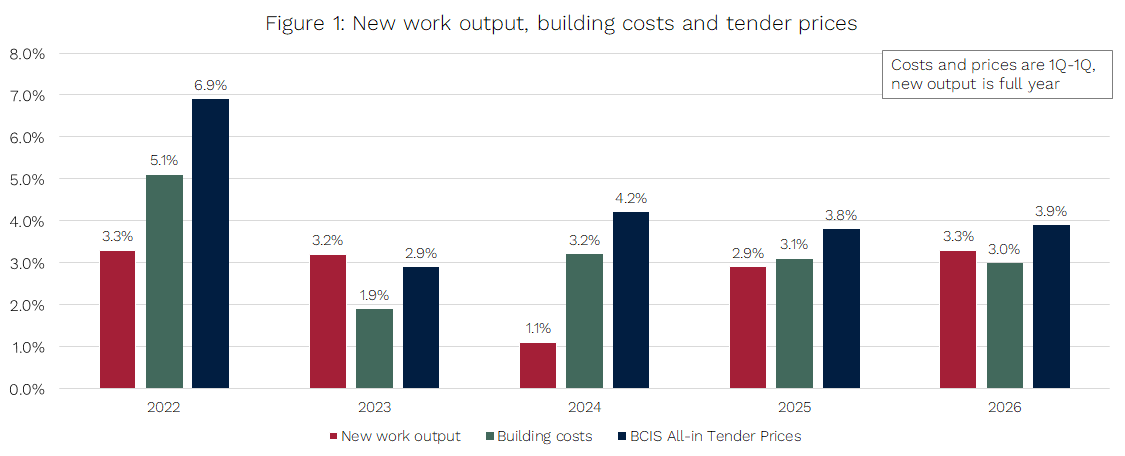

Tender prices are forecast to rise just under 7% in the next year (to1Q2023) as rising costs continue to put pressure on margins.

As cost pressures subside, tender prices are anticipated to rise by around 3% over the following year, and then by around 4% per annum over the remainder of the forecast period, as demand increases.

Tender prices are expected to rise by around 24% over the whole of the forecast period (from 1Q2022 to 1Q2027).

Materials prices are expected to rise by around 15% over the forecast period (from 1Q2022 to 1Q2027). The main risks to materials prices will be disruption of world supply chains, and oil price rises, which will be exacerbated by the effects of the war in Ukraine.

There is currently a shortage of labour, which is having an affect on site rates. According to the Hays/BCIS Site Wage Cost Index, all-in site rates rose by 11% in the year to 1st quarter 2022. By comparison, promulgated national wage agreements, where they were awarded, in 2021 were in the order of 2.0% to 2.5%.

The BCIS General Building Cost Index is expected to rise by around 17% over the forecast period (from 1Q2022 to 1Q2027).

New construction output is forecast to rise by 15% over the forecast period (2026 compared with 2021).

To find out more about the you can access the full BCIS forecast and commentary in the ‘Briefing’ section of the BCIS Online service.