A tool designed for building professionals to help prepare top level cost plans, provide early cost advice to clients and benchmark costs for both commercial and residential buildings

Published: 30/08/2023

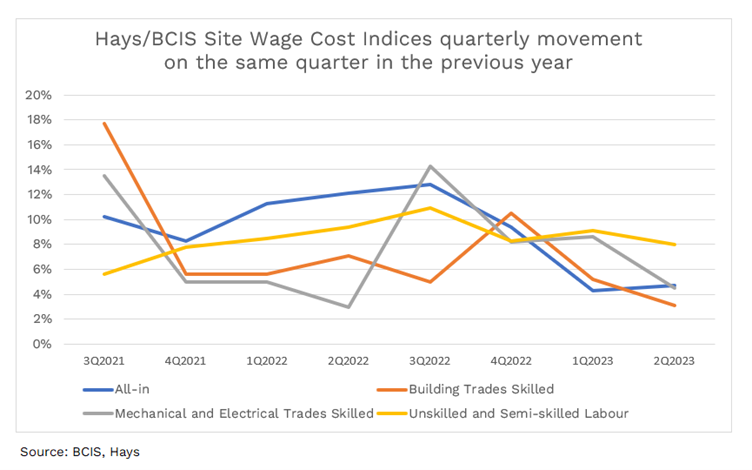

Construction site wages increased by an average of 4.7% in 2Q2023 compared to 2Q2022, the latest data from the Hays/BCIS Site Wage Cost Indices shows. Against the first quarter of the year, average site wages were up 4.2%.

| Skill Level | Percentage change 2Q2023 on | |

| 1Q2023 | 2Q2022 | |

| All-In | 4.2 | 4.7 |

| Building Trades Skilled | 5.0 | 3.1 |

| Improver and Semi-skilled | 8.1 | 0.0 |

| Mechanical and Electrical Trades Skilled | 0.9 | 4.5 |

| Plant Operatives | 5.2 | 8.1 |

| Unskilled and Semi-Skilled | 2.2 | 8.0 |

Source: BCIS,Hays

Reflective of ongoing reports of labour shortages in many parts of the industry, job placement numbers, as recorded by Hays Recruitment, fell again after a high in 3Q2022.

Paul Burrows, who compiles the indices for BCIS and Hays, said: ‘The sharpest fall was among skilled craftsmen, suggesting that availability of workers, rather than availability of work, is an issue. While we expect a slight rise in 3Q2023, the trend is downwards.

‘Reported skills shortages persist in the industry and wage growth is strong against a background of falling new orders.’

Unskilled labour and plant operator wages in 2Q2023 showed the strongest growth on site, with 8% and 8.1% increases respectively on the same quarter last year.

The increases in these categories, which typically include the lowest rates of pay, also reflect the April increase in the National Living Wage, an indication of the effect of years of below-inflation wage rises.

Although new orders have decreased in infrastructure, the effects of which will be seen in coming months, these figures corroborate recent data from ONS, showing a 6.1% increase (2Q2023 on 1Q2023) in construction output in this sector.

The Hays/BCIS Site Wage Cost Indices are produced using market data from Hays Recruitment, reflecting movement in the market for agency labour on a quarterly basis. Agency placements generally represent short-term labour requirements for immediate fulfilment. Because of this, the indexes tend to be more volatile and faster to react to changes in market conditions than other labour indices.

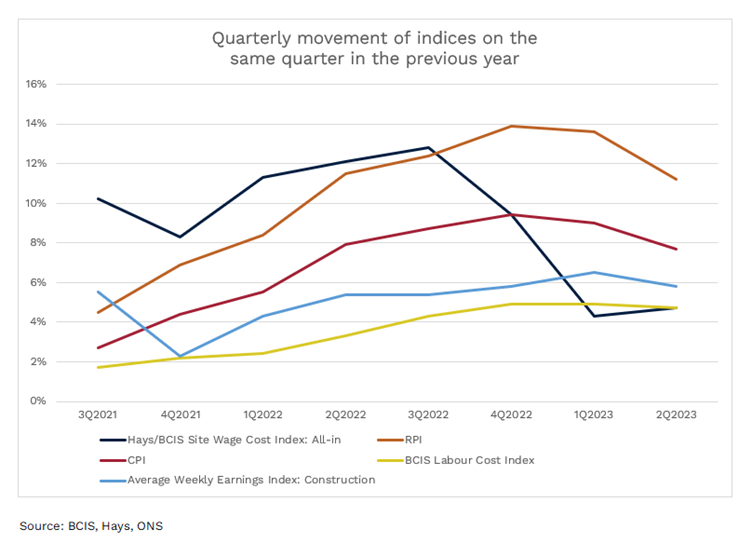

The BCIS Labour Cost Index, for example, incorporates the movement in nationally agreed wage awards, which are generally updated annually, across the industry.

The latest site wages data from BCIS and Hays can also be set against the backdrop of data released by ONS last week, which showed the number of people employed by construction firms in 2Q2023 decreased by 0.7% on 1Q2023, but the number of people self-employed in the construction sector increased by 5.1% in the same quarter.

The ONS data shows the overall construction workforce reduced by 53,000 between 2Q2022 and 2Q2023. Compared to 2Q2019, there are now almost 209,000 fewer workers, with the majority of those lost self-employed.

The Construction Industry Training Board (CITB) stated in its annual report published at the beginning of the year that 224,900 extra workers (44,980 a year) will be needed to meet UK construction demand between now and 2027.

The Hays/BCIS index series is available now on BCIS CapX.

To keep up to date with the latest industry news and insights from BCIS register for our newsletter here.