If you are a housebuilder or developer, please fill in the survey. If you have any questions or would like to discuss the survey, please call +44 0330 341 1000 or email contactbcis@bcis.co.uk

Published: 18/09/2023

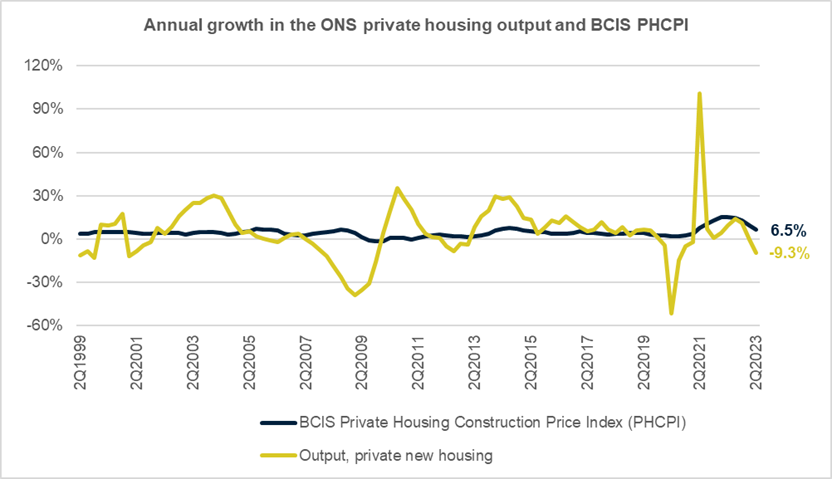

Annual housebuilding cost inflation, as measured by the BCIS Private Housing Construction Price Index (PHCPI), continued to ease in 2Q2023, standing at 6.5% (down from 9.7% in 1Q2023).

Quarterly growth has also slowed, standing at 0.7% in 2Q2023 compared with 1Q2023. The last time quarterly growth was below 1% was 3Q2020 (0.4%).

38% of PHCPI respondents pointed to an increase in subcontractor costs as the main driver of change in costs, and a quarter of respondents cited an increase in materials costs. At the same time, for the third consecutive quarter, a small share of respondents reported a decrease in materials costs (6%).

The slowdown of materials cost inflation is also reflected in the BCIS Materials Cost Index, which reported 2.8% growth in 2Q2023 on the same period in the previous year. This is a significant drop from a peak in the annual growth of 23.5% observed in 2Q2022.

Looking to 3Q2023, the housebuilders surveyed said they expected to see an average 1% increase in costs.

ONS construction output figures, which have been declining since 4Q2022, clearly demonstrate the continued pressure on the private housing sector.

In 2Q2023, private new housing output was down 9.3% on the same quarter a year earlier. There were decreases of 3.3%, 5.9% and 2.1% in quarterly growth in 2Q2023, 1Q2023 and 4Q2022 respectively.

Source: BCIS, ONS

Further, according to the latest data from ONS, the number of private enterprise dwelling starts in England dropped by 17.5% in 1Q2023 in comparison with 1Q2022.

Across the UK, private enterprise dwelling completions in 1Q2023 were 5.0% down on 1Q2020.

A continued drop in demand in the housing market, significantly impacted by increased interest rates over the past 18 months, has again been seen in the latest house price indices. On an annual basis, Halifax saw a decrease of 4.6% in August, the biggest year-on-year decrease since 2009, while Nationwide reported a 5.3% drop, also the weakest rate since 2009.

Further, the Bank of England reported that the value of gross mortgage advances in 1Q2023 was £58.8 billion, which was £22.9 billion lower than the previous quarter, 23.6% lower than in 1Q2022, and the lowest value since 2Q2020.

Big housebuilders continue reporting decreasing demand. Shares in Barratt fell after the firm reported falls in profit and volume, and Berkeley Group said its home reservations were down by more than a third. Persimmon reported in August it expected to complete at least 9,000 homes in 2023, significantly less than the 14,868 it delivered in 2022.

Although headline (CPI) inflation eased in July, the Bank of England’s Monetary Policy Committee is still expected to increase the base rate this week, for the fifteenth time in a row, and continued interest rate increases will adversely impact housing affordability and heap more pressure on housebuilders.

Against a backdrop of continued downtown in private housing output, BCIS forecasts the remainder of this year and the next to be just as challenging for the private housing sector. BCIS expects new private housing output to contract by 15.9% and 4.3% in 2023 and 2024 respectively, before returning to growth in 2025.

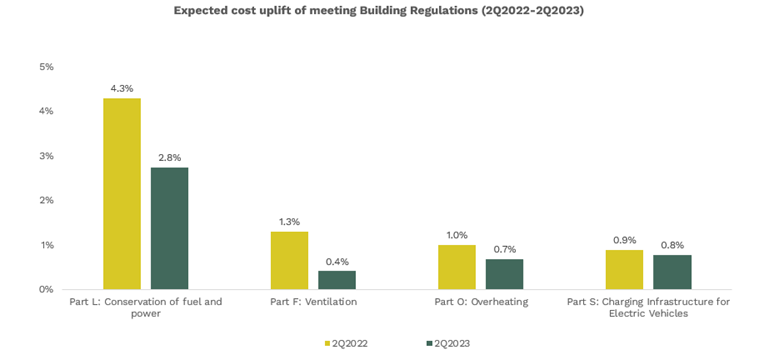

Cost impact of updated Building Regulations

BCIS continues to monitor the impact of updated Building Regulations on housebuilders’ costs. The estimated cost uplift for meeting Part L, as reported by housebuilders in 2Q2023, stands at 2.8% – unchanged from the last quarter and down from 4.3% as reported in 2Q2022.

Source: BCIS PHCPI Survey

More than a quarter of respondents reported a combination of Air Source Heat Pumps (ASHPs) and increased insulation as their chosen solution to meet the requirements of Part L, and one-fifth selected a combination of PV (photovoltaic) and increased insulation. Another fifth selected a combination of gas boilers, PV and insulation, whereas 13% noted a combination of gas boilers and PV. The remaining respondents were split equally, reporting ASHPs, ASHPs and PVs, and gas boilers, PV and ASHPs, as their chosen solutions.

We would like to thank the PHCPI survey respondents for their contribution.

The PHCPI is based on housebuilders’ costs in constructing a standard house. The index is adjusted for changes in specification and only reflects the movement in the underlying direct costs to housebuilders.

If you are a housebuilder and would like to participate in the BCIS PHCPI quarterly survey, please contact contactbcis@bcis.co.uk

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter.