The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 14/07/2025

With a new project pipeline arriving in mid-July, a government U-turn on funding social infrastructure schemes through public-private partnerships (PPPs) and private finance generally could be on the cards.

Ongoing struggles to strengthen the public purse, most notably through now-abandoned welfare cuts, mean private investors will be essential to delivering new work. However, successfully utilising private finance will require models that effectively distribute risk across consortia and deliver real value for money. Cherry-picking the best elements of existing models seems like a good place to start.

The new infrastructure strategy is undoubtedly an opportunity to rebalance the reputation of private finance and its role in public projects. Given the condition of public finances, the government doesn’t have much choice, but it still has its work cut out to change perceptions of investors, and more specifically, PPPs.

The baked-in service elements of old private finance initiatives (PFIs) are a contributing factor to negative opinions. At the start of 2025, 50% of the combined £271.7 billion(1) unitary charge for 653 PFI-funded public projects in the UK had been paid.

Source: Infrastructure and Projects Authority – PFI Dashboard

According to Infrastructure and Projects Authority (IPA) data, this unitary charge(2), which refers to fees paid by procuring authorities to cover the cost of building assets, borrowing debt and equity investment, taxes and operating services, won’t be paid off until at least 2048 when the last projects expire.

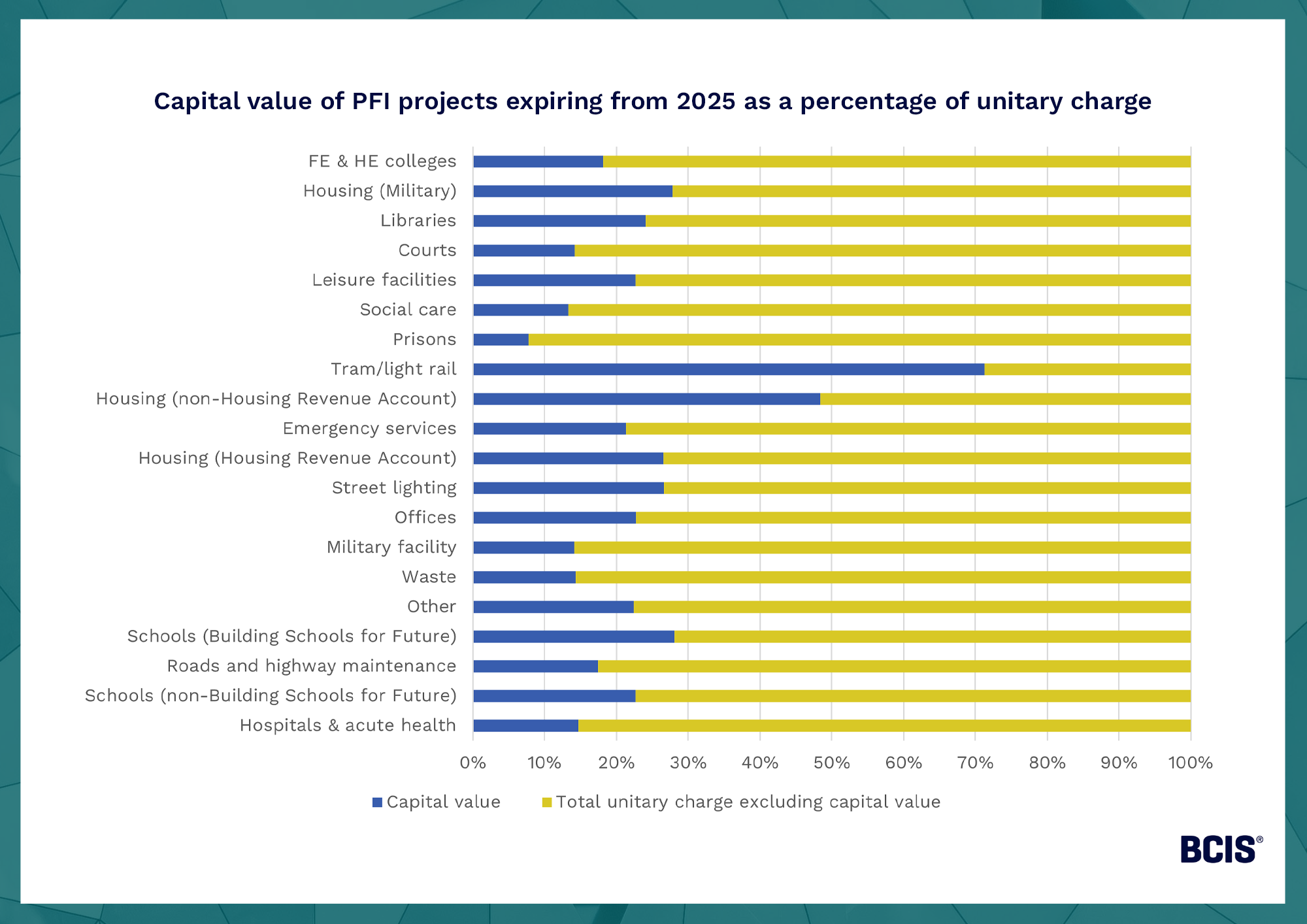

The significant, long-term costs associated with PFIs have typically made it difficult for the government to justify value for money for the taxpayer. Only a small proportion of the total unitary charge is typically spent on the capital value of projects – the total nominal capitalised cost as recorded at financial close. This covers total shareholder investment, any authority capital contribution, and special purpose vehicle debt(3) – money borrowed by a company specifically set up to finance, build and maintain an asset.

Of the 653 projects above, the capital value of projects comprises just 18% of the combined unitary charge.

Source: Infrastructure and Projects Authority – PFI Dashboard

However, the bottom line is that without private involvement, the government’s plans for new built assets and stimulating wider economic growth will remain in blueprint. PPPs provide reliable access to capital funding in a way the public purse cannot and are therefore a better route for simply getting the job done.

In the 10 Year Infrastructure Strategy, the government was rather cloak and dagger on its private finance approach. New economic infrastructure will likely use functioning models, such as the Regulated Asset Base (RAB) that was used successfully on the Thames Tideway Tunnel and has been earmarked for Sizewell C. A verdict on using investors for social infrastructure is to be unveiled in the Autumn Budget.

Given the shortcomings of previous PFIs, it wouldn’t be surprising to see the government employ a redesigned PPP-style model for social infrastructure. But passing on costs to taxpayers and consumers doesn’t really work in education and healthcare projects because there’s no direct revenue stream.

It’ll therefore come down to NISTA (National Infrastructure and Service Transformation Authority) to select a model (or models) that can overcome this hurdle; cherry-picking elements from existing models seems like a sensible first move.

For instance, there’s growing interest in the Welsh mutual investment model (MIM). This model passes ownership of assets to the public sector once contracts complete as well as a share of the profits gleaned from the project. While MIM wouldn’t guarantee the government revenue from social infrastructure projects, it would afford greater involvement and control.

Source: Mutual Investment Model Report – 2022-2024 – Government for Wales

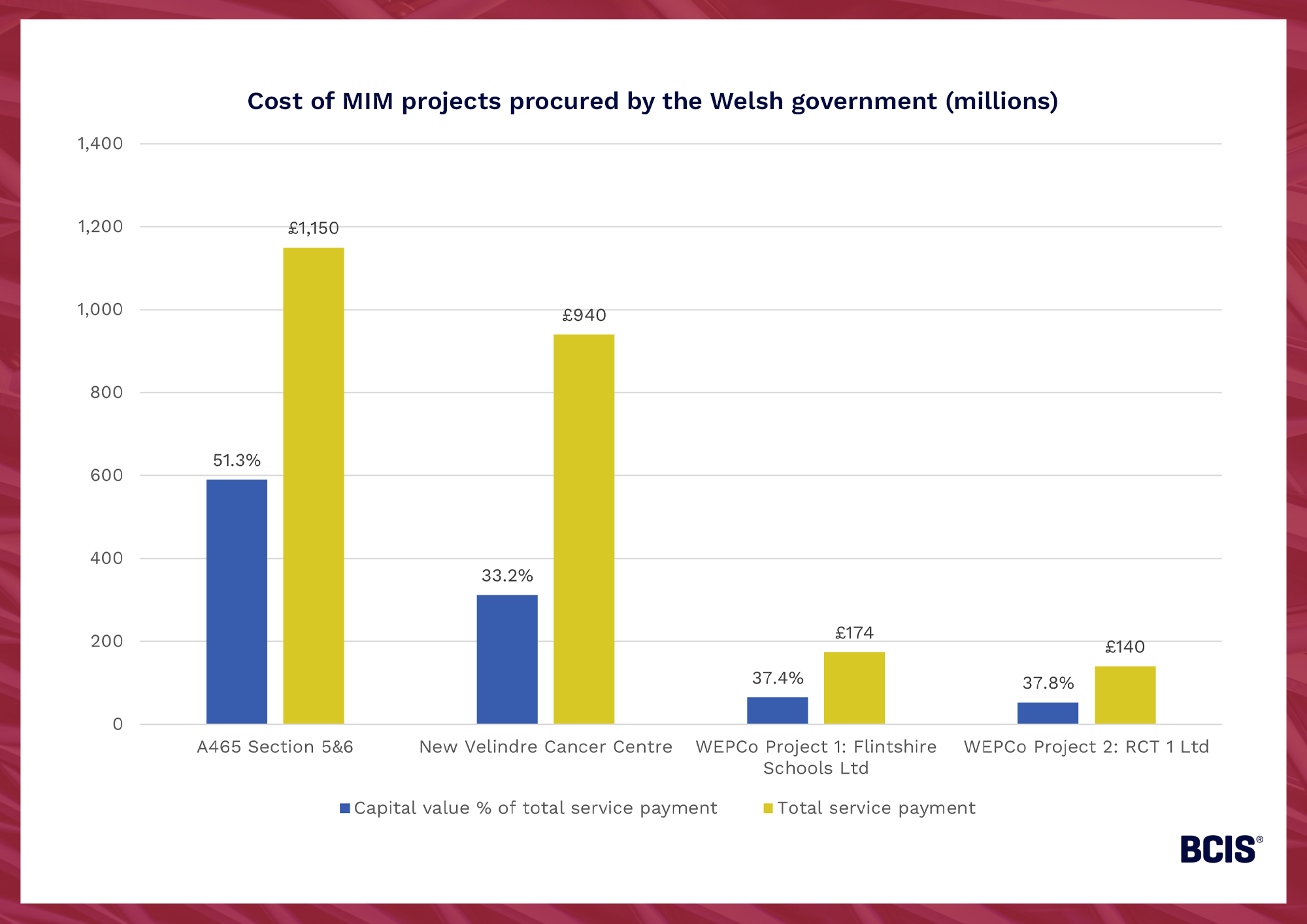

Looking at the latest available data, the Welsh government has used MIM across three initiatives to date, one of which includes two education-based projects.

It’s a little crude to directly compare this data with the information on PFI projects provided by the IPA, but the combined capital value of all four MIM projects(4) being delivered by the Welsh government does appear to comprise a higher percentage (42%) of the total service payment – the MIM equivalent of a unitary charge. This suggests MIM contracts, or using some elements of the model at least, could deliver more value for money on the UK’s wider social infrastructure portfolio.

The government may also consider whether capping private sector returns, as done on the now abandoned Scottish non-profit distributing (NPD) model, could work in future PPP iterations. The measure was introduced to improve value for money but there are big drawbacks, not least of which include disincentivising investors. That said, revisiting such measures on a case-by-case basis could prove a useful way to balance the books.

It’s clear there are several paths the government could choose where private finance is concerned. Lessons learned from PFIs and spin-off PPPs such as the NPD model are useful food for thought and the government itself hinted at its intentions to develop new models in the infrastructure strategy.

One report published by PwC in May(5), suggested the next generation of PPPs must protect spending power where private finance is not appropriate and deliver real benefits for both private and public sector partners.

For contractors, the return of PPPs could reintroduce the risk of operating on thin margins, while investor doubts stem from the high cost of bidding and issues in contract management associated with legacy PFIs. According to the report, establishing a credible, repeatable pipeline that serves contractor and investor interests is the most important step toward introducing a new wave of PPPs.

The proposed six-monthly update to the pipeline is a promising start, and the hope is the preferred funding mechanisms for projects will be revealed alongside the pipeline’s release in the coming weeks.

Funding social infrastructure projects with private investment is never going to be easy, but through past trial and error, this government may still deliver.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) Tableau Public – PFI Dashboard 2023-24 by IPA PPP Team - here

(2) HM Treasury – Infrastructure and Projects Authority – Private Finance Initiative and Private Finance 2 projects: 2018 summary data – here

(3) www.parliament.uk – The Private Finance Initiative: time for honesty – here

(4) Mutual Investment Model Report 2022-2024 – here

(5) Transforming infrastructure investment: A private finance perspective – here