The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 30/01/2026

EY-Parthenon publishes its profit warnings report on a quarterly basis(1). The report outlines the profit warnings issued by FTSE companies across different sectors and provides analysis on the driving factors behind them.

Profit warnings are statements issued to the stock exchange by listed companies to declare that their full-year profits will be materially below management or market expectations.

Key takeaways from the latest profit warnings report

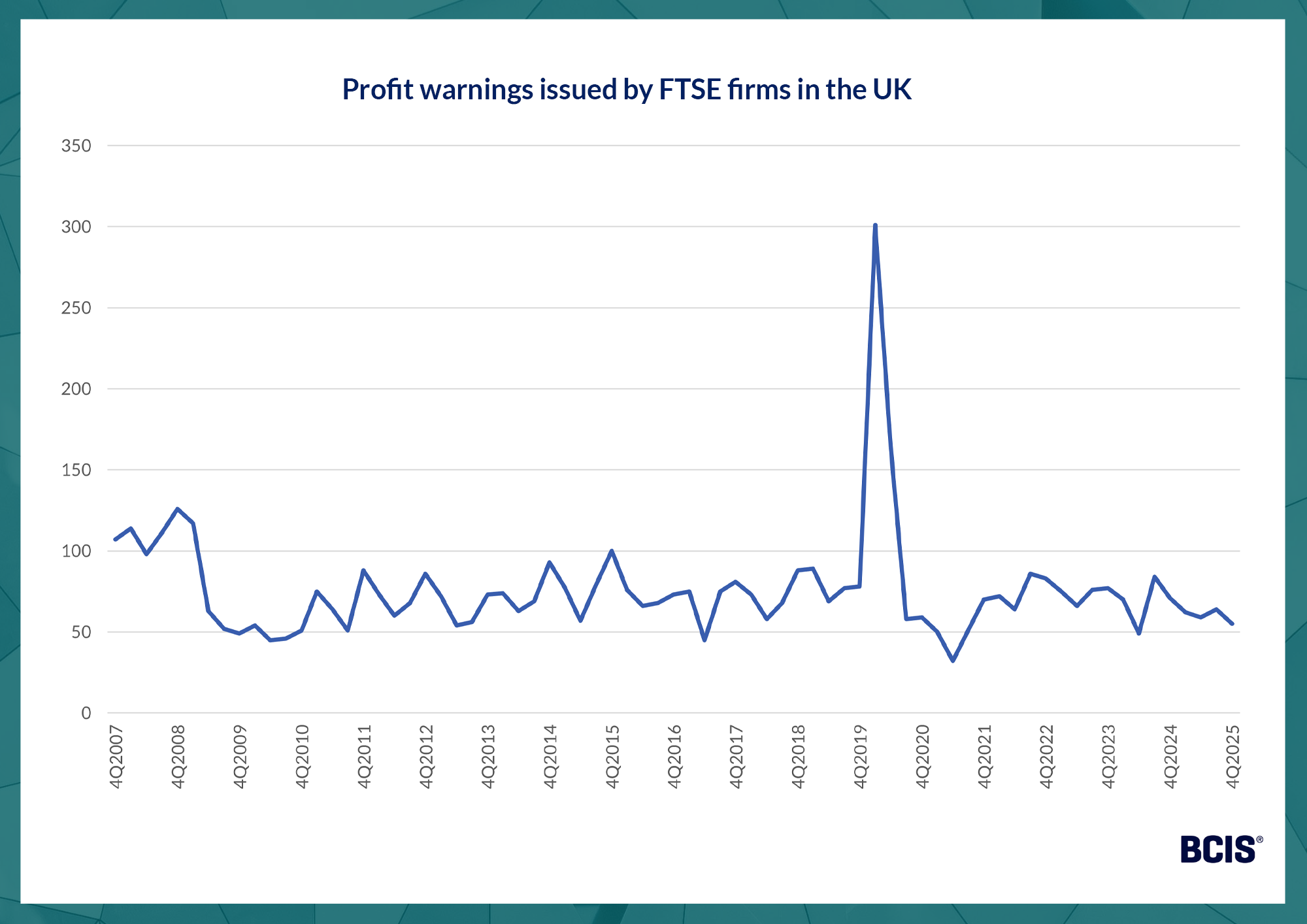

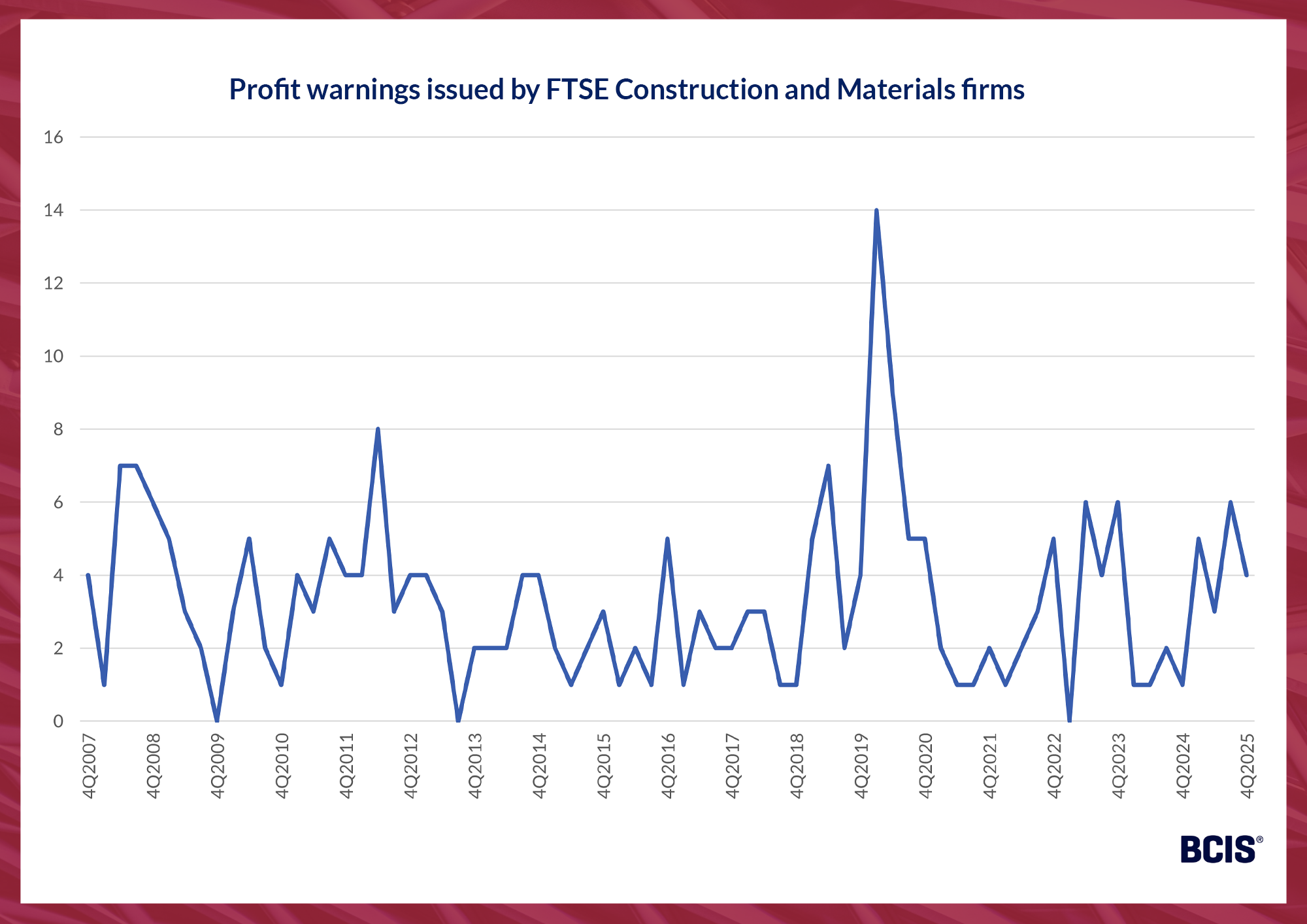

New insight from EY-Parthenon has completed the 2025 picture of profit warnings issued by FTSE Construction and Materials firms in the UK.

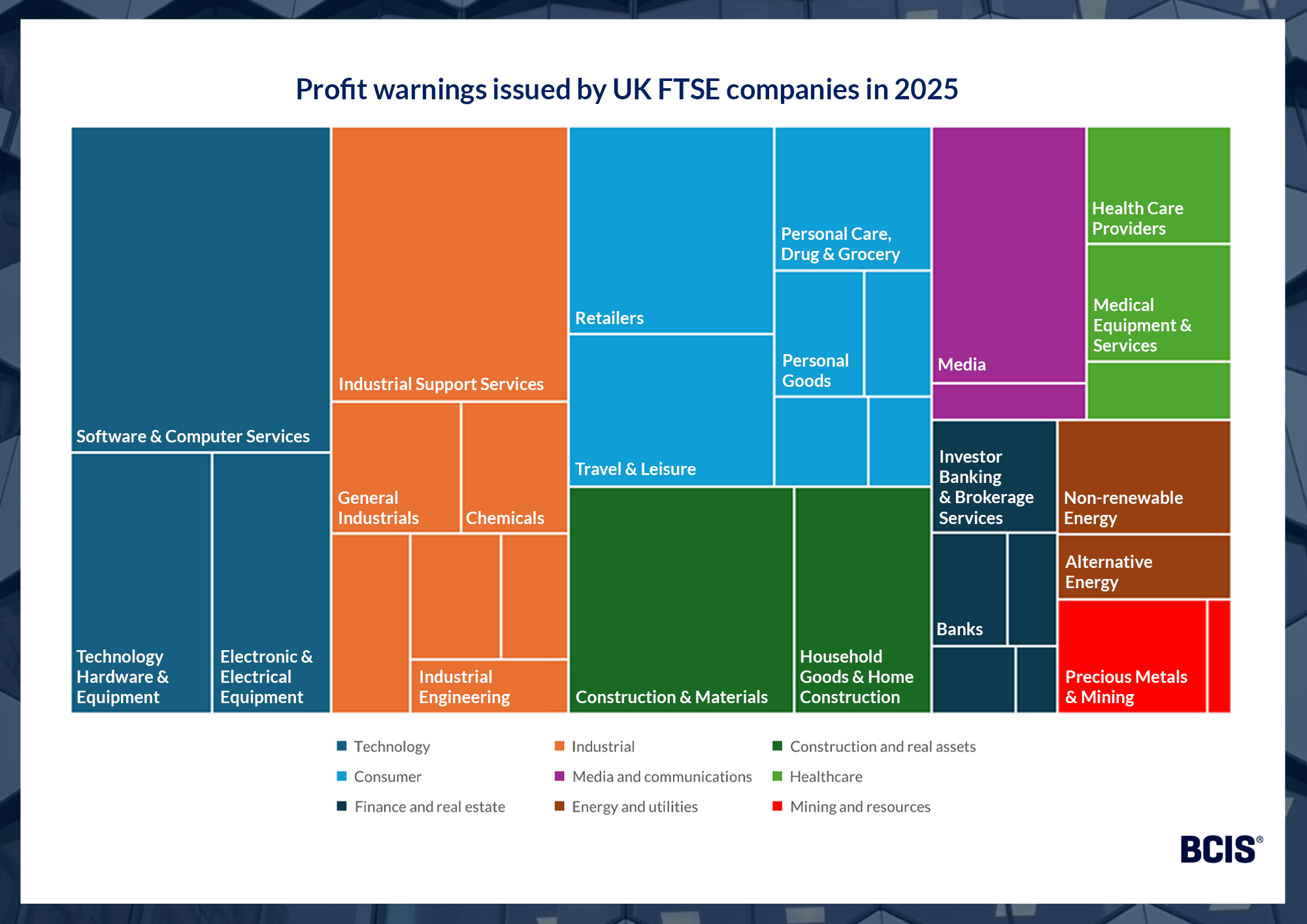

Last year, a total of 18 warnings were issued by firms in the sector, the third highest of all sectors measured behind Software and Computer Services (30) and Industrial Support Services (23).

By comparison, Construction and Materials firms issued five profit warnings in the whole of 2024, less than one-third of 2025’s total.

The latest report from EY-Parthenon also confirmed that around one-third (33%) of firms in the sector issued at least one profit warning in 2025, an increase on 14% the year before.

Further, the sector’s profit warnings comprised nearly 8% of the 240 warnings issued in the UK in 2025. This was up from just under 2% of the 274 warnings issued in 2024.

Source: EY-Parthenon

Uncertainty and geopolitical and policy change were the dominant forces behind UK profit warnings issued in 2025.

Other challenges highlighted by firms included delayed or cancelled orders, cited in 33% of warnings, and weaker consumer confidence or rising costs, cited in 11% of warnings. 15% of warnings were linked to US tariffs.

In many ways, it was a year of two halves. In the first two quarters, difficult macroeconomic and geopolitical conditions had the biggest impact on B2B firms with the second half of 2025 seeing a rise in weaker consumer confidence and changing spending habits.

Source: EY-Parthenon

Looking ahead, EY-Parthenon forecast a continuation of the same pressures.

Uncertainty, low growth, higher costs, ongoing policy change and fast‑moving technological disruption are all expected.

Construction profit warnings in context

Profit warnings insight for construction in 2025 was significantly less optimistic than in 2024.

Warnings in the latter pointed to a period of recovery while warnings issued in 2025 spoke of rising cost pressures, regulatory change and weak demand.

More than half of 2025 warnings from FTSE Construction and Materials firms cited weaker confidence, delays in contract starts or slippage in project timelines, all of which can negatively impact revenues, project delivery and working capital.

Source: EY-Parthenon

Commentary by EY-Parthenon also highlighted labour shortages, legacy liabilities, rising employment costs and increasing regulatory complexity as sources of disruption and pressure. Compliance with the Building Safety Act in particular has held up approvals, as indicated by the latest data from the Building Safety Regulator.

Dr David Crosthwaite, chief economist at BCIS, said: ‘Profit warnings are a useful barometer for identifying trends in major construction firms’ performance. Taken with other data and surveys, such as output, workforce numbers and building control approval figures, EY-Parthenon’s latest report underscores 2025 as a year of both instability and resilience for the sector.

‘With those same challenges prevailing in 2026, it’s important clients and suppliers move forward with intent. Early engagement with the supply chain is essential, as is using appropriate cost indices to inform decision-making and improve risk mitigation, from project inception to completion.’

Unlike other areas of the economy, construction is often disproportionately impacted by cost increases, usually due to fluctuations in demand uncertainty and materials prices.

EY-Parthenon’s latest Restructuring Pulse Survey(2), which drew insights from nearly 200 workout banking professionals (who support firms experiencing financial difficulties) across 33 European countries including the UK, reiterated construction’s vulnerability to economic and geopolitical shocks.

Respondents said that while pressures are broadly stabilising for construction across mainland Europe, the UK counterpart is reportedly experiencing the highest corporate stress levels of any sector.

Survey responses highlighted fiscal tightening, skilled trade shortages and the impact of financing costs on developers and contractors managing capital-intensive projects as key issues.

As raised in EY-Parthenon’s profit warnings report, slow growth, weak demand and the margin-squeezing effect of regulatory complexity were cited as compounding factors.

‘It would be an oversight to call 2026 a fresh start for construction but there are signs that conditions are improving,’ Dr Crosthwaite added.

‘For example, lower interest rates, stronger public sector prospects and, with the exception of December’s data, a decline in inflation.

‘Fair risk allocation, the building of close partnerships between demand- and supply-side parties and vigilant cost management – these are the practices that will bolster the sector in the months to come.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.