The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 12/02/2026

The Office for National Statistics (ONS) publishes monthly estimates of the amount of construction output chargeable to customers for building and civil engineering work in Great Britain, split by sector and type of work(1).

Annual construction output rose in 2025 despite industry challenges

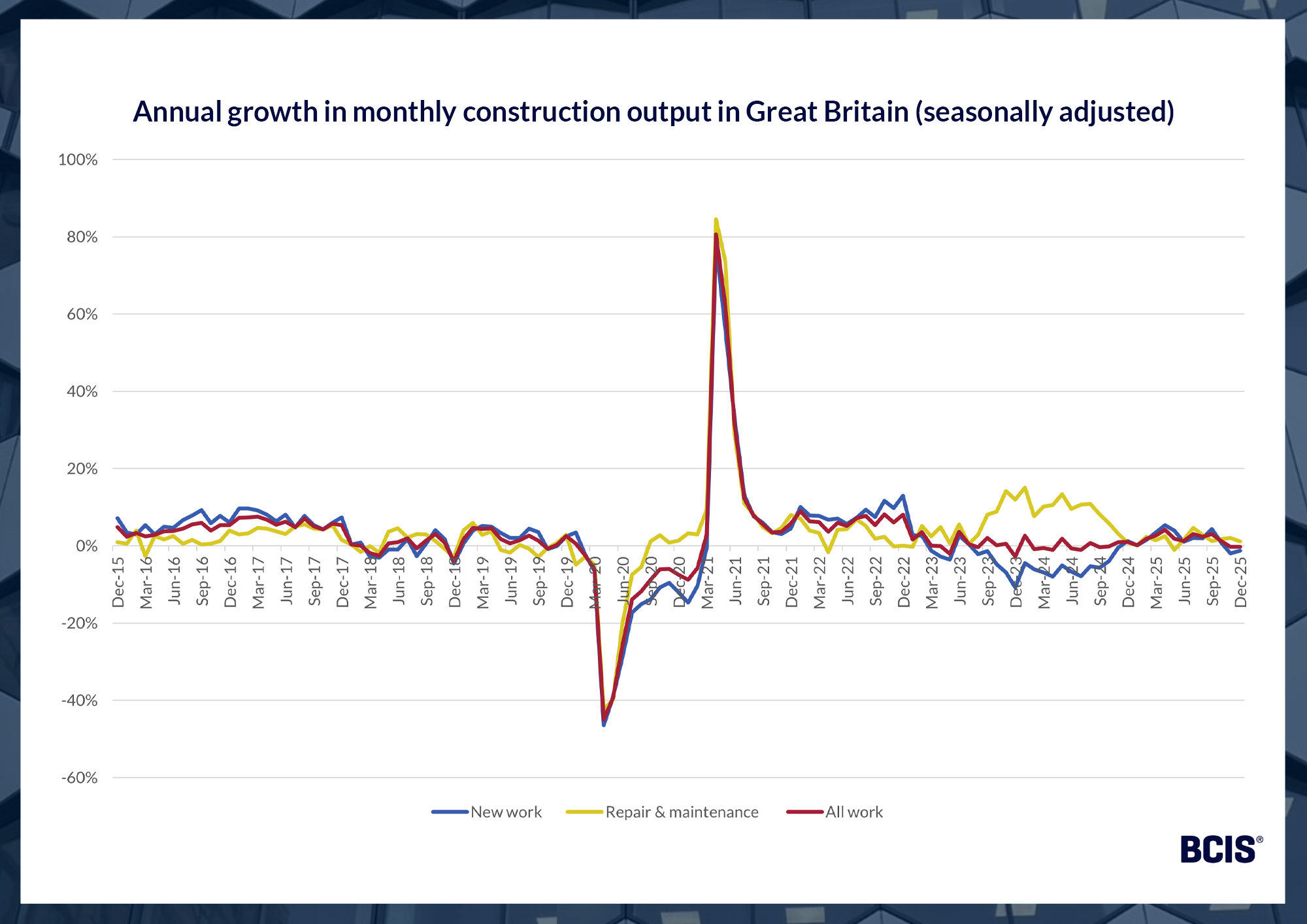

Construction output increased by 1.8% in 2025 compared with 2024, according to the latest ONS data with complete results for last year.

Annual new work and R&M activity both increased, by 1.8% and 1.7% respectively.

The greatest increase seen at a sector level was in private industrial new work, up by 19.5%. This was closely followed by public non-housing new work, which includes health and education projects and rose by 18.6%.

In R&M, non-housing activity saw the biggest increase between 2024 and 2025, rising by 2.5%.

The only sectors to experience an annual decline in output were private commercial new work, down by 8.6%, and public new housing, down by 6.6%.

Dr David Crosthwaite, chief economist at BCIS, said: ‘Given the significant economic headwinds and sector-specific challenges that UK construction faced in 2025, the annual uptick in output is promising. Taken with new orders data, which show a healthy rise in annual orders committed to last year, the latest output figures are testament to businesses’ resilience. The industry even ended up outperforming the wider economy.

‘Of course, that’s not the whole picture. At a sector level, both datasets expose weaknesses in the residential market. Total new housing output only saw a marginal increase in 2025 on 2024 output and new orders for private housing were down. More government support for first-time buyers might go some way to improving demand in the residential sector.

‘Beyond the housing and commercial slowdown, confidence seems to be making a hesitant return. The Infrastructure Pipeline update, ongoing reforms at the Building Safety Regulator and any further reduction in interest rates and inflation should hopefully catalyse more investment decisions in the months to come.’

Monthly output dipped to 15-month low in December

Monthly construction output ended 2025 on a slightly sourer note. Total output declined by 0.5% in December, reaching the lowest level since September 2024. The decrease was due to a 2.5% fall in R&M output. By contrast, new work increased by 1.0%.

At a sector level, the biggest monthly changes were in non-housing R&M, down by 4.9%, and public new housing, up by 4.8%.

On an annual basis, total construction output fell by 0.3% in the 12 months ending in December 2025. New work decreased by 1.3% while R&M rose by 1.2%.

In comparison to December 2024, the greatest new work output increases were in public non-housing, up by 15.0%, and private industrial, up by 6.0%.

The largest year-on-year decrease was in new private commercial output which fell by 10.0%.

In R&M, public housing output fell by 4.9% on the year while private housing output saw an increase of 5.2%.

| Sector | Output in December 2025 compared with | |

| November 2025 | December 2024 | |

| New work | ||

| Public housing | 4.8% | 2.2% |

| Private housing | -0.9% | -6.1% |

| Infrastructure | 1.2% | 2.4% |

| Public non-housing | 3.7% | 15.0% |

| Private industrial | 0.0% | 6.0% |

| Private commercial | 1.1% | -10.0% |

| All new work | 1.0% | -1.3% |

| Repair and maintenance | ||

| Public housing | 2.9% | -4.9% |

| Private housing | -1.2% | 5.2% |

| Non-housing | -4.9% | -0.7% |

| All R&M | -2.5% | 1.2% |

| All work | -0.5% | -0.3% |

Source: ONS – Construction output in Great Britain, volume, seasonally adjusted, by sector, Table 2a

Source: Construction output in Great Britain, volume, seasonally adjusted, by sector, Table 2a

Quarterly output figures

Construction output in 4Q2025 declined by 2.1% on the previous quarter. Both new work and R&M output fell between 3Q2025 and 4Q2025, by 2.6% and 1.5% respectively.

At a sector level, the biggest quarterly increase in output was a 1.1% rise in public non-housing new work. Public new housing experienced the greatest decline, falling by 5.8%.

| Sector | Output in 4Q2025 compared with | |

| 3Q2025 | 4Q2024 | |

| New work | ||

| Public housing | -5.8% | -0.7% |

| Private housing | -3.6% | -3.1% |

| Infrastructure | -1.0% | 1.0% |

| Public non-housing | 1.1% | 16.2% |

| Private industrial | 0.6% | 9.8% |

| Private commercial | -5.2% | -11.2% |

| All new work | -2.6% | -0.8% |

| Repair and maintenance | ||

| Public housing | -0.5% | -7.0% |

| Private housing | -2.9% | 5.5% |

| Non-housing | -0.4% | 0.6% |

| All R&M | -1.5% | 1.7% |

| All work | -2.1% | 0.2% |

Source: ONS – Construction output in Great Britain, volume, seasonally adjusted, by sector, Table 2a

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) Office for National Statistics – Output in the construction industry - here