The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance.

Published: 19/02/2024

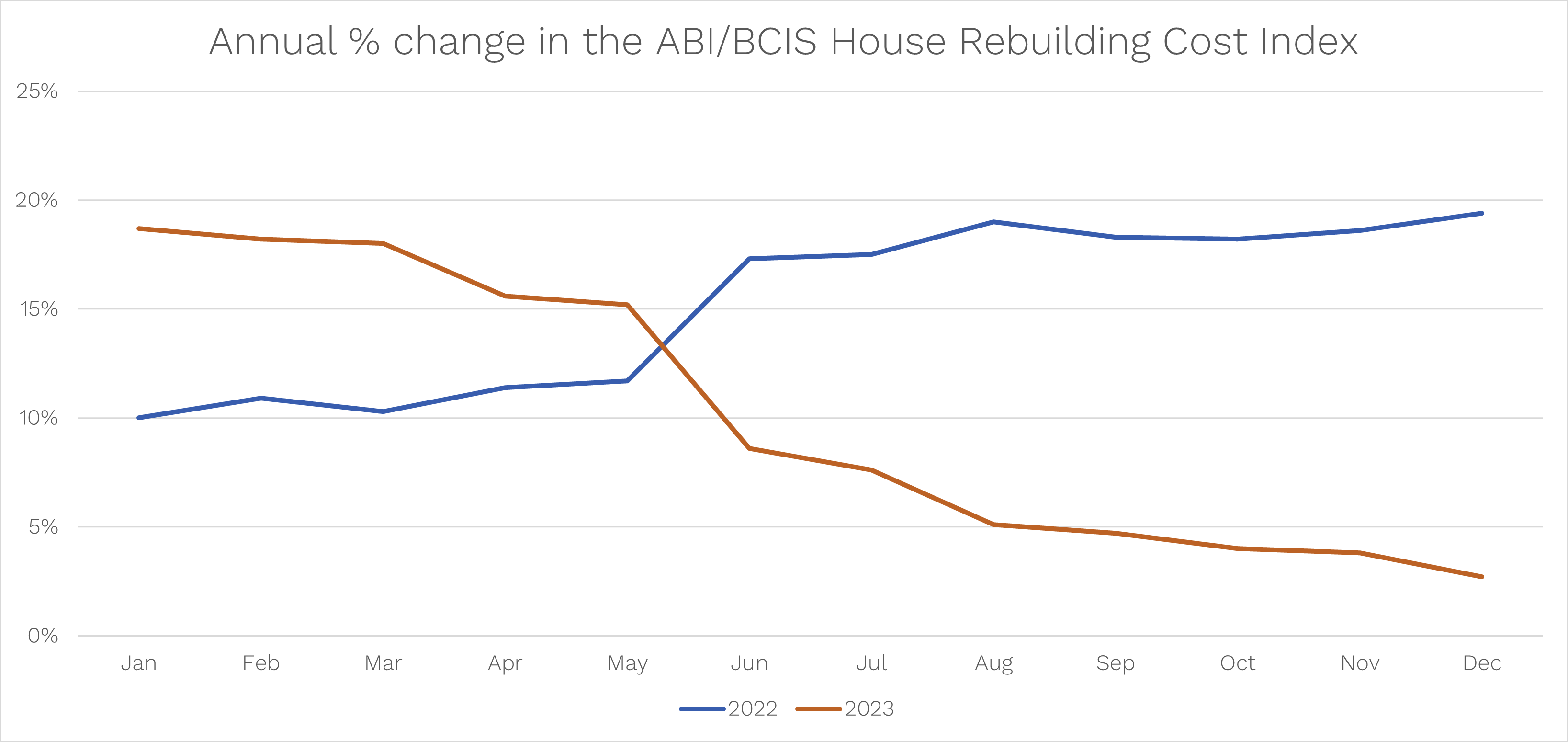

House rebuilding cost inflation calmed considerably in 2023, following a period of soaring price increases.

Annual growth in the BCIS/ABI House Rebuilding Cost Index was 2.7% at the end of 2023, compared to 19.4% at the end of 2022. The latest data for January 2024 shows it was up 2.1% on the previous year.

The index, which is a national average, is based on changes in the rebuilding costs for different house and flat types, resulting from movement in the input costs of labour, materials, plant, profit, overheads and fees.

It also takes legislative and industry changes like new or updated building regulations, and associated cost uplifts, into account.

Source: BCIS

Volatility in the index, which was driven particularly by soaring materials cost inflation and the additional cost of adhering to updated building regulations in 2022, highlights the importance of having up-to-date information when estimating rebuilding costs.

The index is used to update the figures in the BCIS Rebuild Online service, and also by insurance companies in updating cover through the duration of an annual policy.

Karl Horton, Chief Data Officer at BCIS, said: ‘The fluctuations in input costs, as well as the industry context, show how easy it would be to under or overestimate on rebuild costs if you’re not working with current data.’

The consequences of providing inappropriate advice around calculating rebuild costs can be distressing for policy holders and detrimental to insurers.

The latest data from the Financial Ombudsman Service shows that, in 2Q2023, 1,978 complaints were made relating to buildings insurance, sixth highest among product complaints. Of the cases that were referred to an ombudsman for a decision (383), 39% were upheld.

Almost one in five complaints about buildings insurance were put to an ombudsman decision, among the highest proportion of all product complaints.

While cost inflation has cooled, prices have not returned to the level they were before the recent string of crises which have included Covid-19, the invasion of Ukraine and conflict in the Middle East.

Horton said: ‘The House Rebuilding Cost Index was 40% higher in January 2024 than it was in January 2020. On the materials side, we’ve seen annual inflation come right down, but the price of many resources remain high. Labour is also a significant factor in rebuilding cost estimations, and we’ve seen greater annual growth in labour costs than material costs since the second quarter of 2023.’

Notes

The ABI/BCIS House Rebuilding Cost index is a national average and does not take regional differences or local hotspots into consideration, nor does it account for different building and construction types.

The reassessment of individual properties using an index is not advisable. The RICS guidance note Reinstatement cost assessment of buildings states that ‘It is prudent to incorporate recommendations within the report to the effect that the client needs to reassess the sum insured on a regular basis, with an annual adjustment to reflect inflationary effects, and a major review and reassessment every three years, or earlier should significant alterations be made to the insured property.’

BCIS recommends that results obtained by index linking should always be checked.