The BCIS Intelligent Rebuild Cost Platform is an insurance tool that provides reinstatement building assessments for commercial and residential properties. Designed to reduce the risk of underinsurance, the service leverages multiple datasets, which combine BCIS reinstatement data with satellite technology. With cases of incorrect insurance valuations on the rise, it assesses portfolio risk, while saving time and money. Request a demonstration today

Published: 07/11/2024

It’s no secret that materials cost inflation has had a negative impact on the construction industry in the last few years. The latest figures from the Insolvency Service show that construction firms accounted for 17.4% of all insolvencies in England and Wales in August 2024 – a 1.1% increase on the 4,263 insolvencies recorded in the year to August 2023, and a 33.9% increase on the 3,218 in pre-pandemic 2019. This means the sector has consistently experienced the highest number of insolvencies of all registered businesses in the UK for the past two years.

But the rise in the cost of materials has also had a knock-on effect across the wider industry, triggering an unprecedented rise in reinstatement values. However, with materials cost inflation continuing to abate – could the price of premiums fall?

Get it right from the start

Before understanding the impact materials can have on reinstatement values, it’s worth examining why it’s so important to obtain an accurate declared value from the start.

At its simplest, the declared value is the total sum the insurer calculates to ensure there’s enough to cover the reinstatement of the building and all its material facets, on a like-for-like basis, from day one of the policy term – in the event of the worst-case scenario. The onus is on the policy holder to provide the correct and right information to ensure this is achieved. But equally, it’s on the insurer to equip their clients with enough adequate information – this requirement was introduced in last year’s Consumer Duty Act (brought in and overseen by the Financial Conduct Authority (FCA).

Unfortunately, it’s often the case that property owners – whether they own a single dwelling or manage an entire portfolio – are unprepared for the worst-case scenario. The shock and disbelief that comes with the destruction of their assets is often compounded by the dire realisation their policies don’t provide adequate cover for the sum required for reinstatement.

Underinsurance occurs when the insurance cover or sum insured (the maximum amount of money the insurer is obliged to pay in the event of a claim), is less than the value at risk. In other words, the amount of money the insurer offers isn’t enough to complete the repairs or replace what was damaged.

Increasingly, this is a common reason for buildings insurance complaints, which are on the rise. Figures from the Financial Ombudsman Service (FOS) show there were 6,497, in total, in the last financial year (2022-23) – an increase of over a quarter, compared to the year before where complaints reached 5,101.

A harder market

Although underinsurance isn’t a new phenomenon for the insurance industry, it’s become more of a significant problem in a market hit by extreme fluctuating materials prices. Previously, when prices were relatively stable, insurers had more financial wriggle room to accommodate inaccuracies because inflationary pressures weren’t as extreme.

This ‘harder market’ has led to higher instances of proportional settlement of claims in the industry. For example, if a building were insured for £500,000 but its actual reinstatement value was £1 million, the building would be underinsured by 50%. If a partial loss occurs costing £250,000 to reinstate, the insurer could apply the average clause, reducing the payout to reflect the level of underinsurance. As the building was insured for only 50% of its value, the insurer might cover 50% of the loss and pay out £125,000. This would leave the policyholder with a shortfall of £125,000.

Material world

So, what’s the link between materials inflation and underinsurance? There are materials that will always need to be factored into the potential cost of a rebuild – the most immediately obvious are bricks, concrete, structural steel and tiles, as well as all the materials required for plumbing and heating, and electrical engineering.

From the pandemic to the war in Ukraine and the escalation of violence in the Middle East, a series of unforeseen events have contributed to soaring costs manufacturing and procuring materials (due to the rise in oil and gas prices), as well as supply chain issues; further exacerbated by disruption to international trade routes.

Although it is the rises in the Consumer Price Index (CPI) that tend to hit the headlines, indexes show that skyrocketing inflation has had an even more adverse impact on the construction industry.

Compared with January 2020, in the BCIS Price Adjustment Formulae Indices (Building) Series 3, there was an increase of 86% in the Concrete: Reinforcement index by June 2022, and of 42% in Softwood Carcassing and Structural Members by October 2021.

The BCIS/ABI House Rebuilding Cost Index (HRCI), which measures house rebuilding costs, has been equally volatile. Over the last few years, it’s had periods of relatively extreme fluctuation – as of October 2024, the index has increased by 42.6% from January 2020. Annual movement peaked at 19.4% in December 2022.

Security blanket

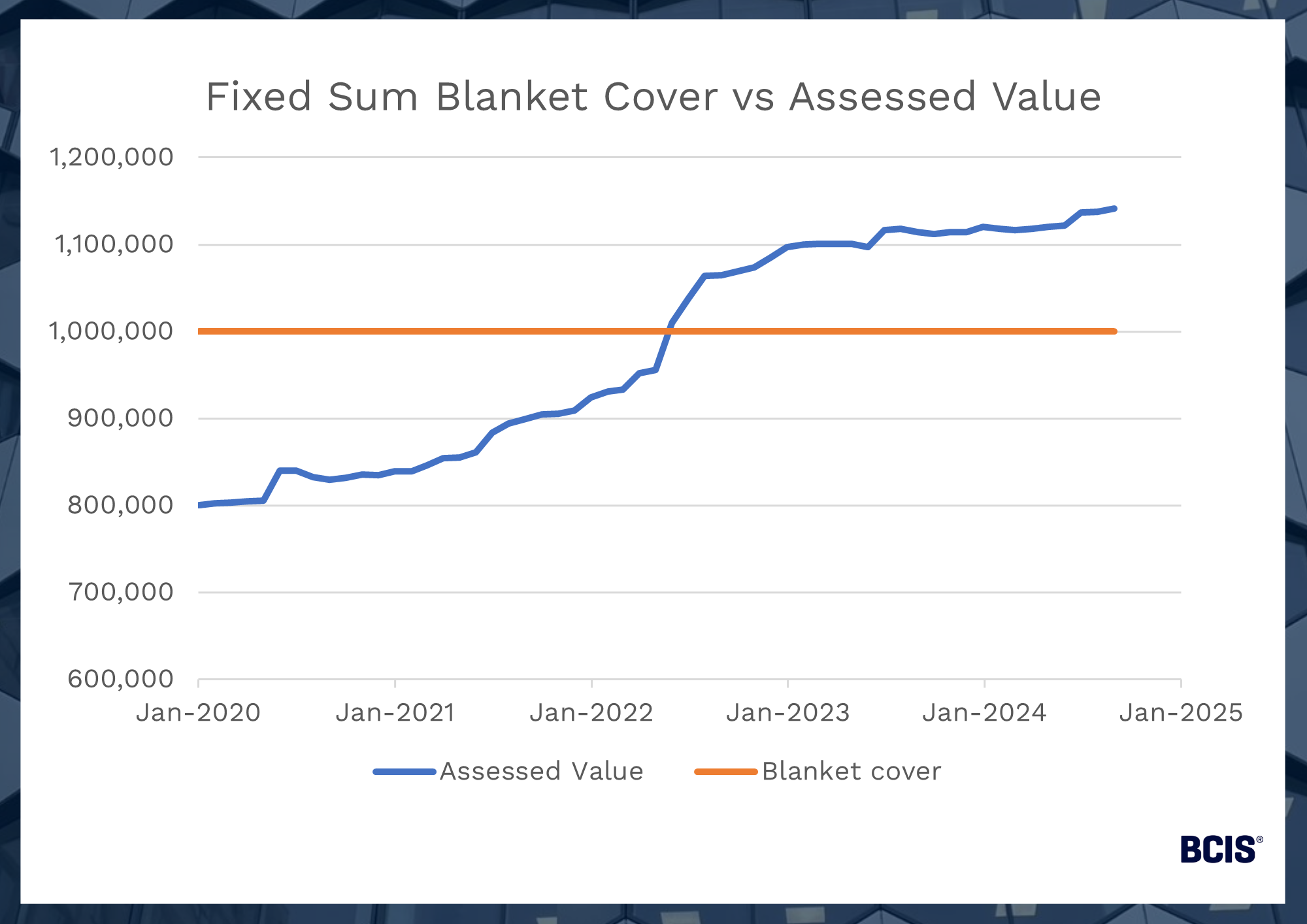

Of equal concern is the fact that many residential property owners are increasingly vulnerable as they continue to rely on blanket insurance policies that cover them for total buildings losses of up to a million pounds. Although this is a significant sum, it’s unlikely to be enough to cover the increase in construction costs that it may have done, say, five years ago. The BCIS House Rebuilding Cost Calculator is another tool that insurers and brokers can highlight to their customers to ascertain whether this is enough cover for their requirements.

Risky business

The extreme rises in prices have had an inevitable impact on reinstatement costs. Even if the estimated cost of materials is correct at the point the asset was originally insured, the declared sum may not be enough to cover the cost of procuring them in the event of a rebuild; further down the line. The best way to factor in these kind of cost fluctuations is to ensure the contract in the policy is linked to an appropriate index; specifically, one that will give a more accurate indication of construction costs, such as the House Rebuilding Cost Index for the Association of British Insurers (ABI). Otherwise, it’s highly unlikely the level of coverage will align with the expense of restoring a damaged property.

The more recent development of automation tools that draw on multiple data sources can also help to mitigate the risk of materials inflation and ensure more accurate reinstatement costs. One such tool is the BCIS Intelligent Rebuild Cost Platform (IRCP). Designed to tackle the rise in underinsurance, it leverages multiple datasets, which combine BCIS reinstatement data with satellite technology. In the development of the BCIS Intelligent Rebuild Cost Platform, analysis of a portfolio of 355 commercial properties found the reinstatement value to be £1.17bn underinsured, a figure we anticipate is just the tip of the iceberg.

From one crisis to another

Materials cost inflation continues to indicate the period of high peaks and soaring price increases could be behind us. Annual growth in the BCIS/ABI House Rebuilding Cost Index was 2.7% at the end of 2023, compared to 19.4% at the end of 2022. The latest data for January 2024 shows it was up 2.1% on the previous year.

However, prices still haven’t returned to the level they were before the recent string of crises which have included Covid-19, the invasion of Ukraine and conflict in the Middle East. Indeed, the House Rebuilding Cost Index was 40% higher in January 2024 than it was in January 2020. So, although annual inflation has come down on the materials side, the price of many resources remains high.

The latest data published by the Department for Business and Trade shows that although construction materials prices for All Work fell by 1.1% in the 12 months to August 2024, some materials, such as flexible pipes and fittings saw the largest annual increase at 17.4%.

In addition to this, a recent BCIS survey – that polled more than 200 professionals in surveying and insurance roles – showed that 24% believe changes in construction costs contribute most to incorrect reinstatement valuations.

Conclusion

Events such as Covid and the war in Ukraine war have contributed to unprecedented peaks in materials cost inflation over the last four years. And although materials prices have abated, they remain high. It would also be wise to assume the worst may not be behind us yet, as the violence in the Middle East continues to escalate. For example, if the continued conflict between Israel and Iran disrupts oil production, energy prices could skyrocket once again, impacting materials prices. Therefore, given the volatility of construction materials costs over the last few years – and the possibility this could continue – it’s more important than ever to have up-to-date information, when estimating rebuilding costs.

Brokers and insurance agents may have little control over the final information their clients provide. But they do have a duty to ask enough clear and specific questions to correctly represent the sum insured. And with 33% of complaints upheld by the FOS last year, it’s integral to preserving a business’ reputation.

Therefore, they need to be armed with the right information and ready to educate their customers on the reasons why their policies need to be adjusted, linked to relevant construction indexes and regularly updated (at least every three to five years).

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.