If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 07/08/2024

BCIS has six golden rules for choosing an index:

1) Be clear about what you want to measure and how you want to apply it.

2) Choose an index that is measuring the costs that most closely match 1.

3) If you are using the index to link the cost of something in a contract or agreement, be clear that it meets your needs, particularly in respect of:

- frequency of the publication (monthly, quarterly, annual)

- updating and revisions policy

4) Understand the inputs to the index and the calculation methodology.

5) Read the notes and definitions.

6) Never choose an index because of its past performance.

Here’s further guidance on applying these rules:

What is an index?

Before we start, it’s worth reiterating what an index is.

The Encyclopaedia Britannica defines it as: ‘a sign or number that shows how something is changing or performing, e.g. The price of goods is an index [indication] of business conditions; or a number that indicates changes in the level of something (such as a stock market) when it rises or falls.’

The indices that BCIS produce are all the former, they are an indication of how prices or costs are moving, expressed as a numerical series with a base of 100.

What do you want to measure?

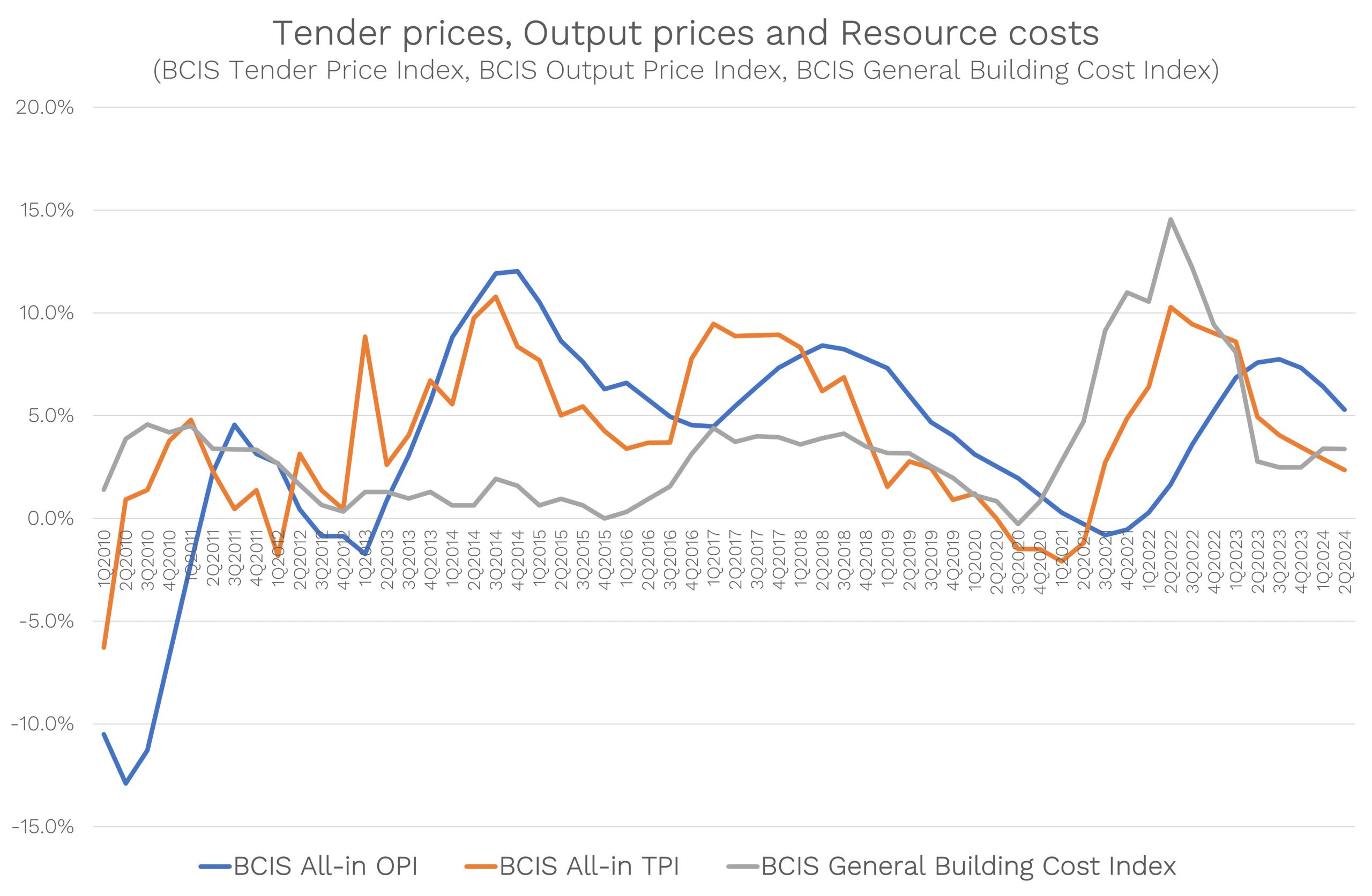

In the context of construction, our indices measure:

- Tender prices – the prices included in tenders for new projects in a period.

- Output prices – the prices paid for work carried out in a period.

- Resource costs – the costs paid by a contractor for resources (labour, materials and plant) in a period.

Source: BCIS

There are also indices of general inflation in the economy, such as the Consumer Prices Index (CPI).

In any transaction, price and cost are the same thing – the seller’s price is the purchaser’s cost. When we name our indices at BCIS, the convention is to call what the contractor pays ‘costs’, and what the contractor charges ‘prices’.

The construction industry typically works with several layers of sub-contractors and suppliers: you need to understand the level that costs are measured.

For example, factory gate – the price charged by the manufacturer; site gate – the price charged by a merchant or subcontractor, which could include several layers of merchant or factor in overheads and profit.

There are indices for different sectors of the industry – building, civil engineering, and maintenance. We also publish indices for plant and equipment.

It’s important to ask – do you want an index for complete projects, or for individual trades or particular materials? In recent times, particularly volatile trades and materials(for example, steelwork) have been singled out for adjustment.

Our most popular indices are the building Tender Price Index and the General Building Cost Index – both based on complete buildings – as well as the Price Adjustment Formulae Indices (PAFI), part of our BCIS CapX package, which measure costs at the trade level.

Applying an index

You also need to understand how to apply an index. Price indices are suitable for bringing construction costs to a chosen date, so are used in cost planning and benchmarking; cost indices, such as PAFI, are suitable for index linking to adjust for cost inflation.

Matching an index to your requirement

Once you have decided what type of index, you must ensure that the available series can be applied in the way you require, especially if you’re using it in a contract:

- Frequency: Do you need a monthly, quarterly, or annual index?

- Status: How will you choose to apply provisional figures?

- Revisions: How will you apply revisions to published indices?

What if the index is discontinued?

If the index you’ve been using has been discontinued, in most cases BCIS will suggest several alternatives and, should they meet your requirements, support with linking the two.

However, if you’re using the index in a contract, it’s advisable to arrange an alternative, if the contract index become unavailable.

Index calculation methodology

It’s important that you understand how the index is calculated and what the inputs are.

BCIS publishes ‘Notes and Definitions’ for each of its series, which set out the calculation methodology and revisions protocol.

For example, the BCIS cost indices are based on factory gate materials prices and nationally agreed wage awards and employment costs; the tender indices reflect merchants’ charges and site labour rates as well as the main contractor’s overheads and profit.

Warning

When choosing an index there’s a natural urge to look at its past performance but this should never be the reason for choosing one index over another – rather, you need to understand what the index is measuring.

BCIS Indices

BCIS Cost Indices (13 series)

BCIS Tender Price Indices (10 series)

BCIS Output Price Indices (1 series)

BCIS Maintenance Cost Indices (22 series)

BCIS Cleaning Cost Indices (2 series)

BCIS Energy Cost Indices (8 series)

ABI/BCIS House Rebuilding Cost Index (1 series)

BCIS Measured Term Contract Updating Percentages (these are calculated, but not published, as an index) (78 series)

BCIS Price Adjustment Formulae Indices:

- Building (65 series)

- Civil Engineering and related Specialist Engineering (43 series)

- Highways Maintenance (32 series) BCIS Plant and Equipment Indices

- UK Manufacture (37 series)

- EU Imports (22 series)

- Non-EU Imports (22 series)

Hays/BCIS Site Wage Cost Indices (6 series)

ONS Retail Prices (RPI and CPI) (3 series)