Published: 11/02/2026

Buildings insurance was the eighth most complained about financial product or service in the third quarter of the 2025/26 financial year (October to December), according to the latest data published by the Financial Ombudsman Service (FOS)(1).

The service received 1,483 complaints, of which 38% were upheld – a 3% decrease on the number of complaints received in the previous quarter and the same proportion upheld.

A common reason for complaints related to buildings insurance policies is underinsurance, where the consumer does not receive their claim in full because the reinstatement valuation provided was too low.

In these instances, when the ombudsman investigates a complaint, they look at the information that was provided by both the insurer and the insured, and where the rebuild cost estimate came from.

Cos Kamasho, Insurance Data Manager at BCIS, said: ‘There are lots of reasons a reinstatement valuation could be too low, from something as simple as the property owner incorrectly using the market valuation, to a multi-billion pound commercial portfolio not being assessed regularly or thoroughly enough to have an up-to-date and reliable figure.

‘The policyholder has a responsibility to supply the right figure and there’s an onus on insurers and brokers to ensure they’ve done everything they can to provide adequate cover. Where that process breaks down, complaints inevitably end up with the Financial Ombudsman.’

In the 2024/25 financial year a total of 7,321 complaints were investigated by the FOS. This was 7% more than the 6,846 cases in 2023/24. Buildings insurance complaints have increased each year for the last three years, consistently appearing in the top 10 services or products drawing complaints.

Source: Financial Ombudsman Service

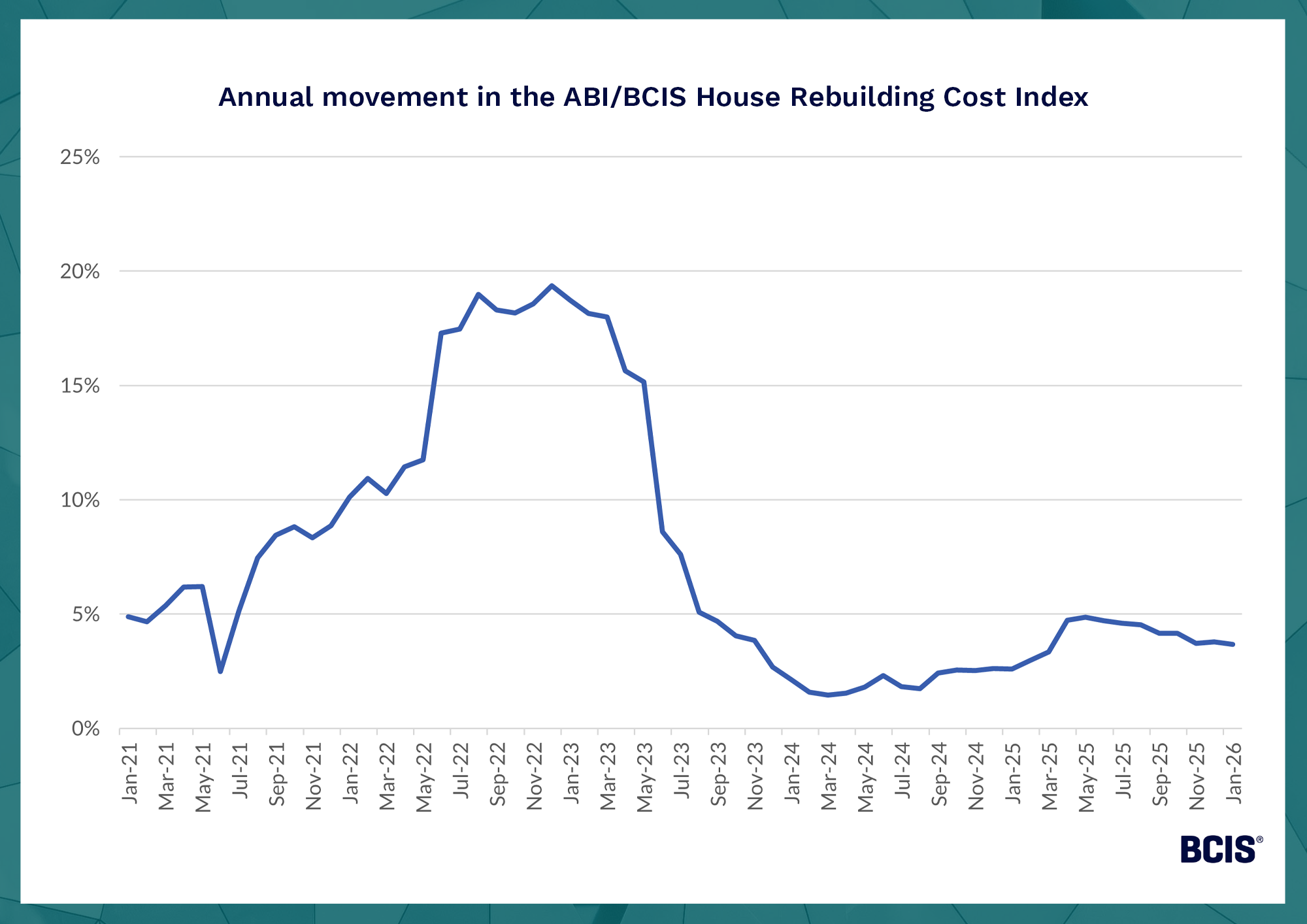

Movement in BCIS rebuilding cost data shows just how volatile construction has been over the past few years, and how important it is for rebuild estimates to be based on reliable, up-to-date data.

Growth in the ABI/BCIS House Rebuilding Cost Index, which is used to update the BCIS ProtX service and by insurance companies to update cover through the duration of an annual policy, peaked at 19.4% in December 2022, driven particularly by soaring materials cost inflation and the additional cost of adhering to updated building regulations.

Source: BCIS

While materials cost inflation has cooled considerably, prices in many housebuilding trades remain high, and are still rising, albeit at a slower pace. Continued conflict in eastern Europe and the Middle East also presents an ongoing inflationary risk.

Kamasho said: ‘Although we’re not seeing rampant inflation anymore, there is still external pressure on costs. Annual growth in the BCIS Labour Cost Index, which tracks movement in trade wage agreements, for example, was 6.3% in 4Q2025 (provisional) – driven particularly by increases to employers’ National Insurance Contributions and the National Living Wage, and there are widely reported skills shortages in the industry. The over 20% increase in Landfill tax from April 2025 has also added to the cost of disposing demolition debris and building wastes.

‘The full Future Homes and Building Standards set to come into effect this year are also expected to greatly impact rebuild values as properties will have to be rebuilt to the new enhanced standards, not what was in place when the property was first built.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

BCIS - reinstatement cost data

(1) Financial Ombudsman Service – Quarterly complaints data: Q3 2025/26 - here