A tool designed for building professionals to help prepare top level cost plans, provide early cost advice to clients and benchmark costs for both commercial and residential buildings

Published: 30/05/2022

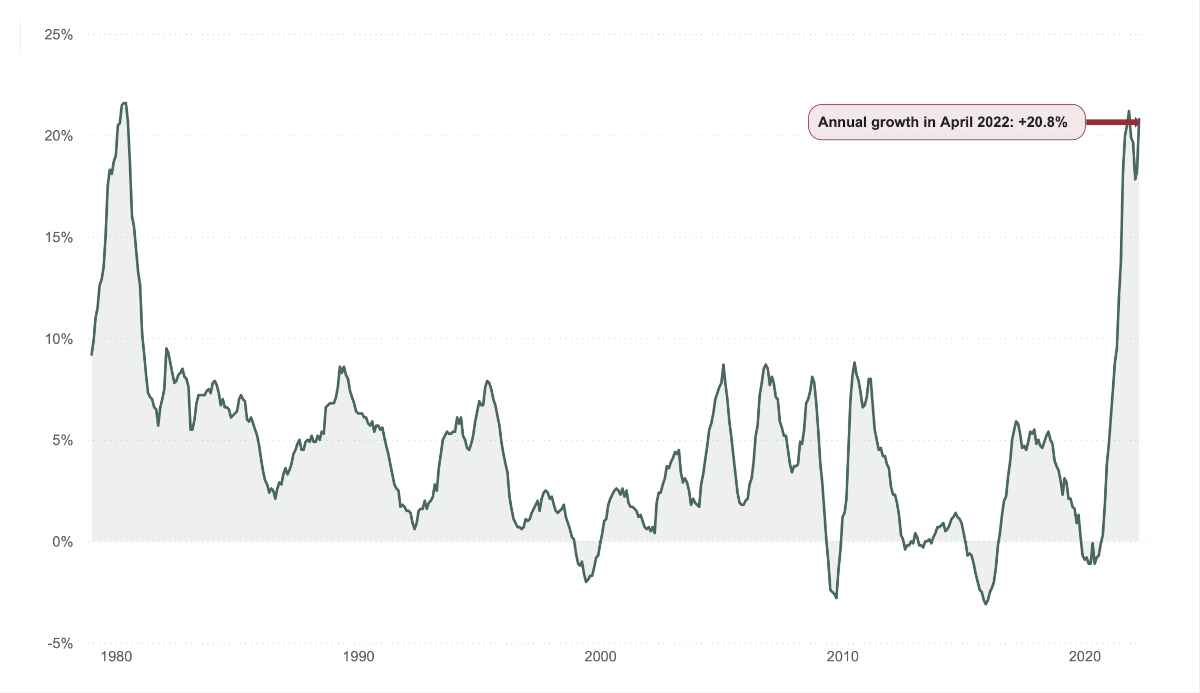

The BCIS Materials Cost Index has increased at an unprecedented rate, indicating that the cost of building materials continues to grow. The annual growth was in excess of 20% in both November and April, up from a low of -1.1% as recently as June 2020. The last time materials inflation was this high in 1980 it had built up gradually.

At the end of 2021, BCIS reported that the annual growth in its material cost index reached a 40 year high. Since then, pressures on the supply chains have persisted and labour shortages have become even more acute. Although the lifting of the COVID restrictions was a positive sign and many industry players reported that they have exited the pandemic more efficiently than before, the war in Ukraine has put the construction industry in further turmoil.

Annual % change in the BCIS materials cost index

Source: BCIS Online. Indices for February, March and April 2022 are provisional and subject to change

Analysis of the price movement of various components of the BCIS Materials Cost Index shows significant increases across all the groups of materials, with the highest increases observed in the categories of steel and oil products. Based on the latest publication of Price Adjustment Formulae Indices Series 4 – Civil Engineering and related Specialist Engineering, other materials showing annual increases in April in excess of 25% were aluminium products (43.2%), precast concrete structural components (36.2%), lifts and escalator materials (29%), metal structures (26.7%) and timber (25.9%)*.

The growth of PAFI Gas Oil (Diesel in Construction)* showed an annual increase of 175.3% in April 2022, incorporating both increase in the price of oil as well as a one-off percentage uplift of 40% applied to reflect the removal of the Red Diesel rebate.

While gas, crude and refined oil imports (which represent three of the top five UK imports from Russia in 2021) have increased substantially over the last five years, recent sanctions and embargoes are adding further inflationary pressure to global energy markets. The price of European Brent crude rose sharply to over USD130 in early March (compared to USD86 in January). Since then, the price of crude has stabilised at USD110 at the end of April 2022 and overall UK fuel stock levels have recovered.

However, structural concerns remain regarding the reduction in domestic and global refining capacity over the past decade. Substantially increased refinery margins ensure fuel pump prices are now rising more quickly than crude oil prices. This is particularly significant for diesel and other distillates (many of which are imported from Russia) and will continue to be a concern for the construction industry which relies heavily on diesel.

Removal of the Red Diesel rebate has further contributed to inflationary pressures on the construction sector. According to the BCIS Red Diesel survey conducted in February 2022, respondents anticipated significant increases in their fuel costs resulting from the removal of the rebate.

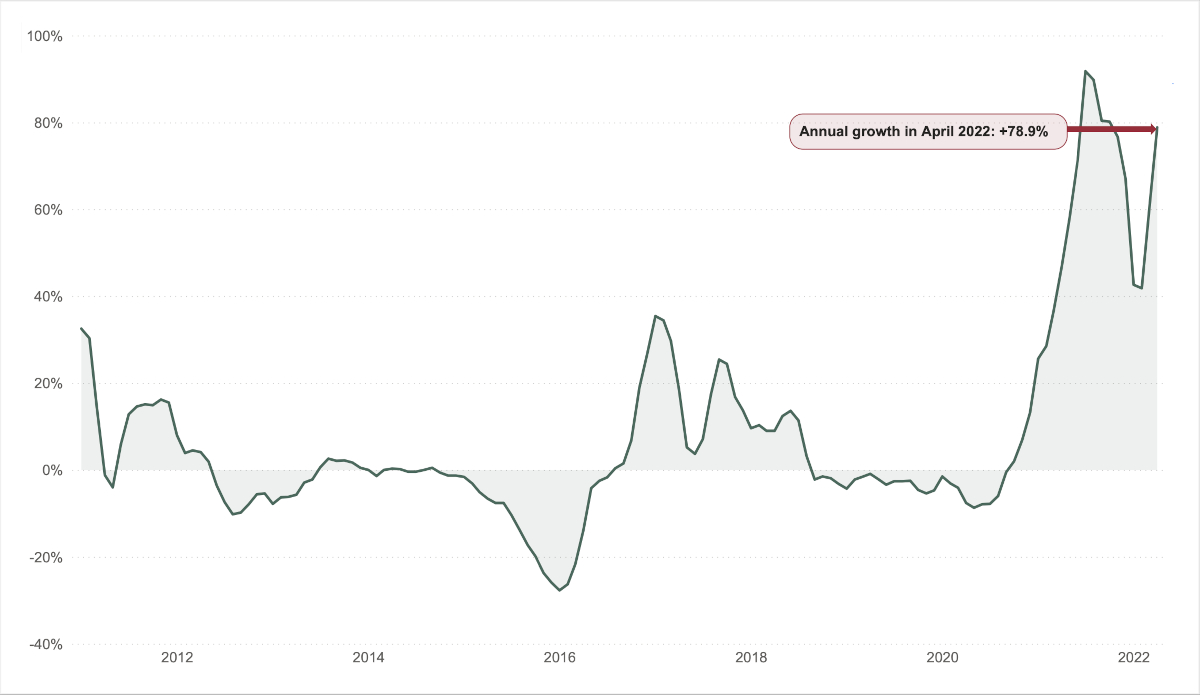

Steel products have also been in short supply and experienced substantial price increases. Prices have been extremely volatile since the beginning of the pandemic and the war has further exacerbated this trend. The highest increase in this category within the PAFI Series 4 – Civil Engineering and related Specialist Engineering has been recorded for the PAFI Steel for Reinforcement index*. The provisional index for April grew by 78.9% on the annual basis or 15.7% on a monthly basis. The latter is the second highest monthly increase since the initiation of the series (the highest increase of 18.9% was observed in March 2022). BCIS’s data contributors have attributed it mainly to the impact of the war in Ukraine.

Annual % change in the PAFI Steel for Reinforcement index

Source: BCIS Online, Price Adjustment Formulae Indices 4/CE/18

In March, British Steel increased prices of structural sections by £250 per tonne for new orders due to an unprecedented rise in production costs. Moreover, British Steel could not guarantee these prices beyond the end of April. While exports from major steel manufacturers in Ukraine have recovered somewhat in recent weeks, the volatility of energy and raw materials costs endure.

Materials cost increases are expected to remain a concern throughout this year. According to the results of the latest BCIS Contractor’s Tender Climate Survey (CTCS), 90% of contractors cited the short duration of quotation validity and increasing material costs among their top concerns over the next six months. Looking ahead, the BCIS Materials Cost Index is forecast to grow by 7.4% in December 2022 compared to December 2021, with materials cost rises to remain a concern due to worldwide supply issues, increased raw material input costs, energy inflation and labour shortages.

* PAFI Series 4 – Civil Engineering and related Specialist Engineering for April are provisional and subject to change. Indices listed are 4/CE/15 Precast Concrete Structural Components (including pipes), 4/CE/18 Steel for Reinforcement index, 4/CE/21 Timber, 4/CE/25 Aluminium Products, 4/CE/26 Metal Structures, 4/CE/28 Gas Oil (Diesel in Construction) and 4/CE/LE/02 Lifts and Escalators Materials.