The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance.

Published: 18/07/2025

The Office for National Statistics (ONS) publishes monthly updates on average weekly earnings across the whole economy and by industry and sector in Great Britain. This commentary relates to ONS’s EARN02 and EARN03 datasets, which cover non-seasonally adjusted earnings, excluding bonuses and including arrears.

Note: ONS’s April 2025 update to earnings data included exceptional revisions dating back to October 2020, which have been reflected in our services and in the commentary below.

Earnings growth slows in construction sector

Construction wages, as measured by ONS’s Average Weekly Earnings dataset(1), increased by 3.9% in the year to May 2025. This was a decrease on the 5.1% rise seen in the 12 months to April 2025. On the month, earnings were up 0.6%.

Across the whole economy, the average increase in earnings in the year to May 2025 was 4.9%, down from 5.0% in April.

Dr David Crosthwaite, chief economist at BCIS, said: ‘Wage increases across construction and the wider economy continue to slow, likely as the result of higher employment costs following the National Insurance rise in April.

‘Whether wage increases will continue their downward trend remains to be seen given the recent unexpected uptick in wider economy inflation as measured by the CPI. Although, with vacancies currently falling and unemployment rising, some downward pressure on future wage increases is expected.’

Annual growth in earnings was lower in construction than the whole economy average for the first time in five months in May 2025.

Source: ONS – Construction (K5AH) and Whole economy (KA5H), non-seasonally adjusted average weekly earnings, excluding bonuses, including arrears

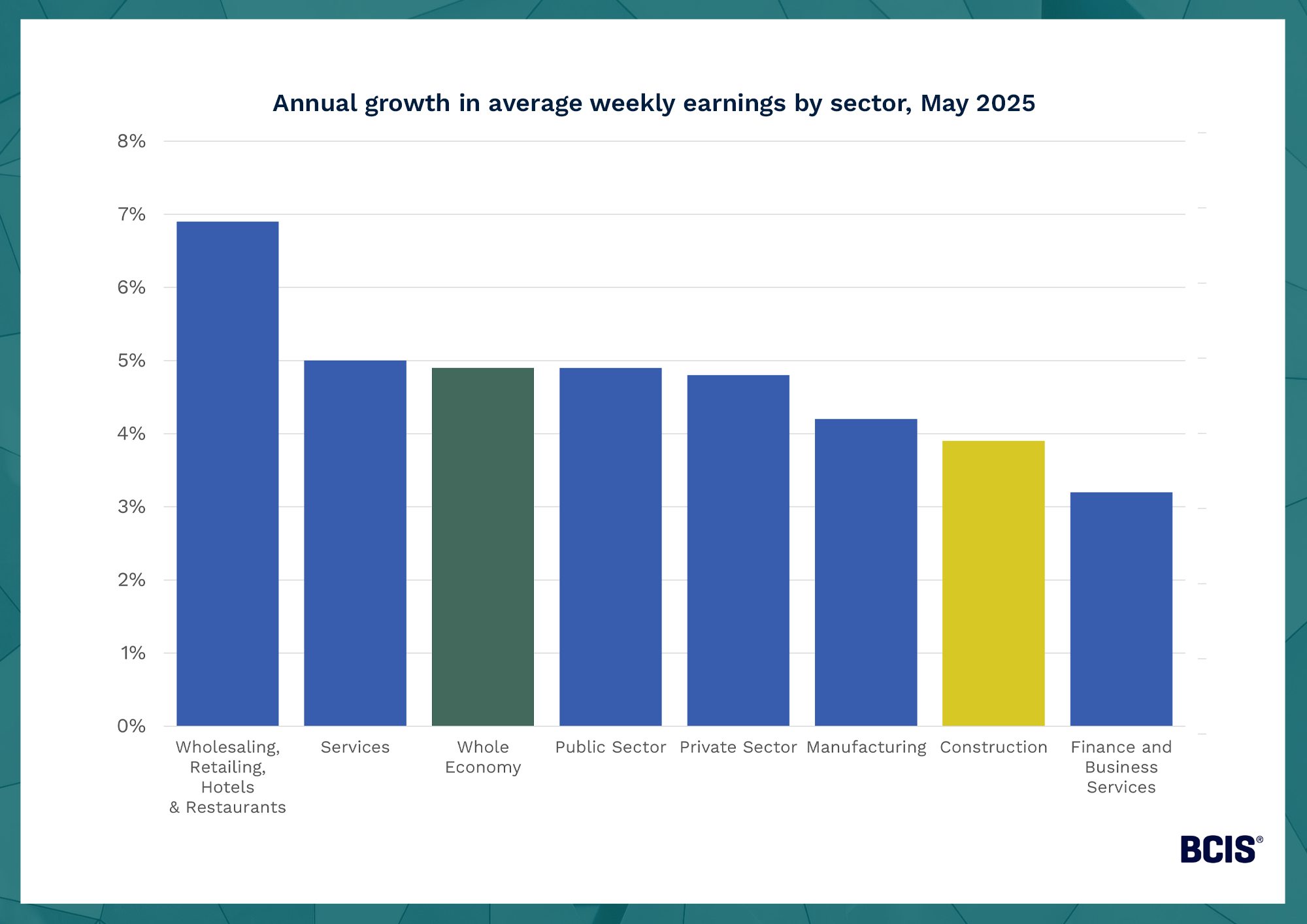

Comparing pay at a sector level (with index K56S), construction workers saw the second lowest annual increase in average earnings across all sectors. The greatest rise was a 6.9% increase in the wholesaling, retailing, hotels and restaurants sector.

Source: ONS – EARN02: Non-seasonally adjusted Average Weekly Earnings, excluding bonuses, including arrears, at sector level

The ONS data show that the construction sector has experienced the most extreme fluctuations in earnings movement in recent years, from a 9.4% annual decrease in May 2020 to a 13.5% increase in May 2021.

Source: ONS – EARN02: Non-seasonally adjusted Average Weekly Earnings, excluding bonuses, including arrears, at sector level

BCIS produces five-year forecasts of the Average Weekly Earnings construction (K5AH) and whole economy (KA5H) time series for subscribers of BCIS OpX.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) Office for National Statistics – Average weekly earnings in Great Britain: July 2025 - here