BCIS CapX includes price adjustment formulae, a method of calculating the increase, or decrease, in contractors’ costs over any period. The formulae and indices (over 200 of them) are widely used in various sectors in the construction industry, including civil engineering contracts and facility management.

Published: 21/01/2026

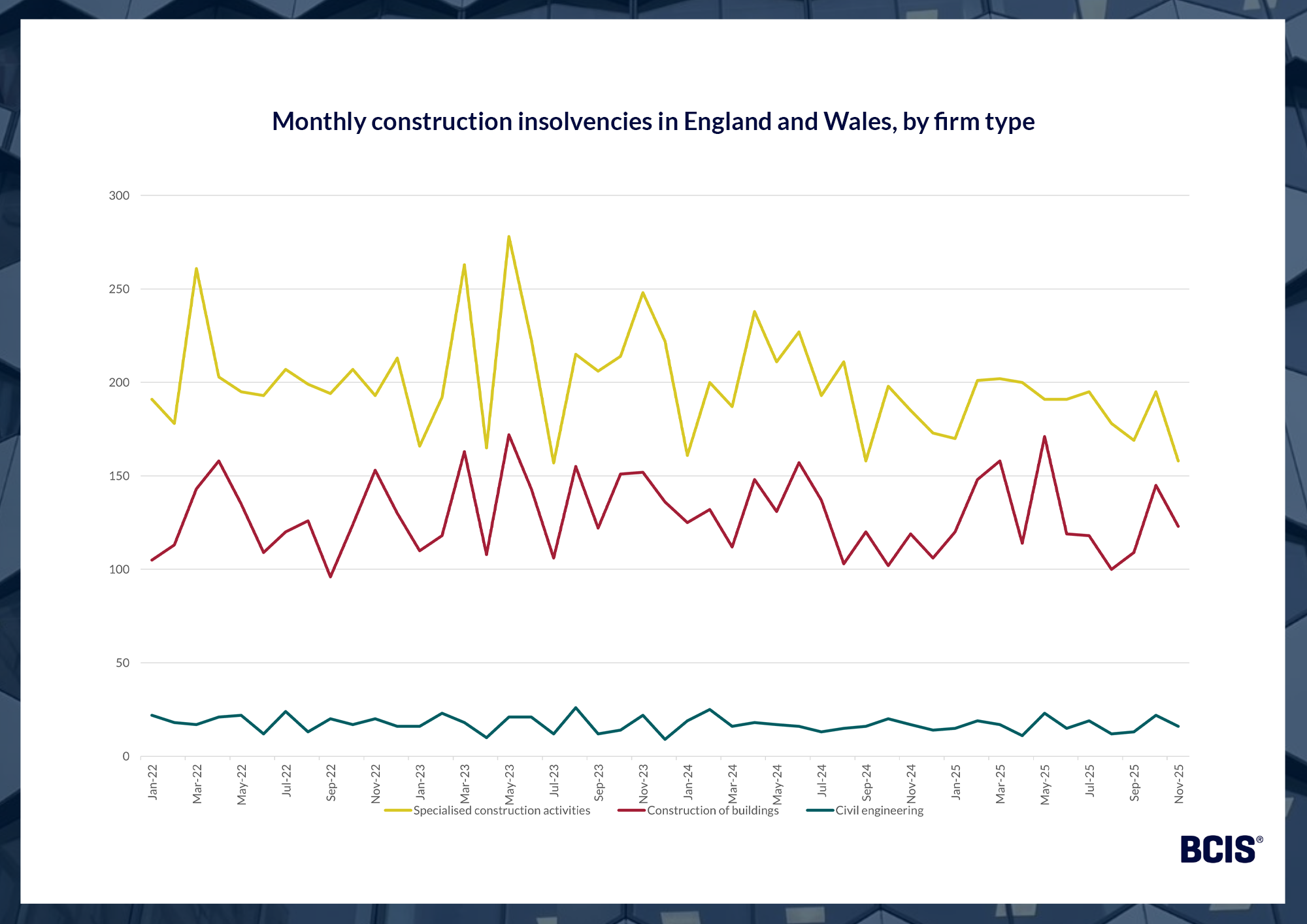

Construction firms accounted for 15.7% of all insolvencies in England and Wales in November 2025, according to The Insolvency Service(1), with 297 registered construction businesses becoming insolvent.

This was 65 fewer than had been recorded in October 2025 and 24 fewer than the 321 recorded in November 2024.

By rough comparison, construction firms accounted for 14%(2) of all registered businesses in the UK as of September 2025.

The largest proportion of construction insolvencies were among firms providing specialised construction activities with 158 recorded in November – 37 fewer than were recorded in October.

The total number of construction firms becoming insolvent in the 12 months to the end of November 2025 was 3,950. This was a 4.0% decrease on the 4,114 insolvencies recorded in the year ending in November 2024 and a 22.6% increase on the 3,221 in pre-pandemic 2019.

Source: The Insolvency Service

Of all cases where the industry was captured in the statistics, construction experienced the second highest number of insolvencies in the year to November 2025.

The Insolvency Service said that while the insolvency rate has increased since the lows seen in 2020 and 2021, it remains much lower than the peak of 113.1 per 10,000 companies seen during the 2008-09 recession. This is because the number of companies on the effective register has more than doubled over this period. The rate in the year to the end of November 2025 was 52.5 per 10,000 companies(3).

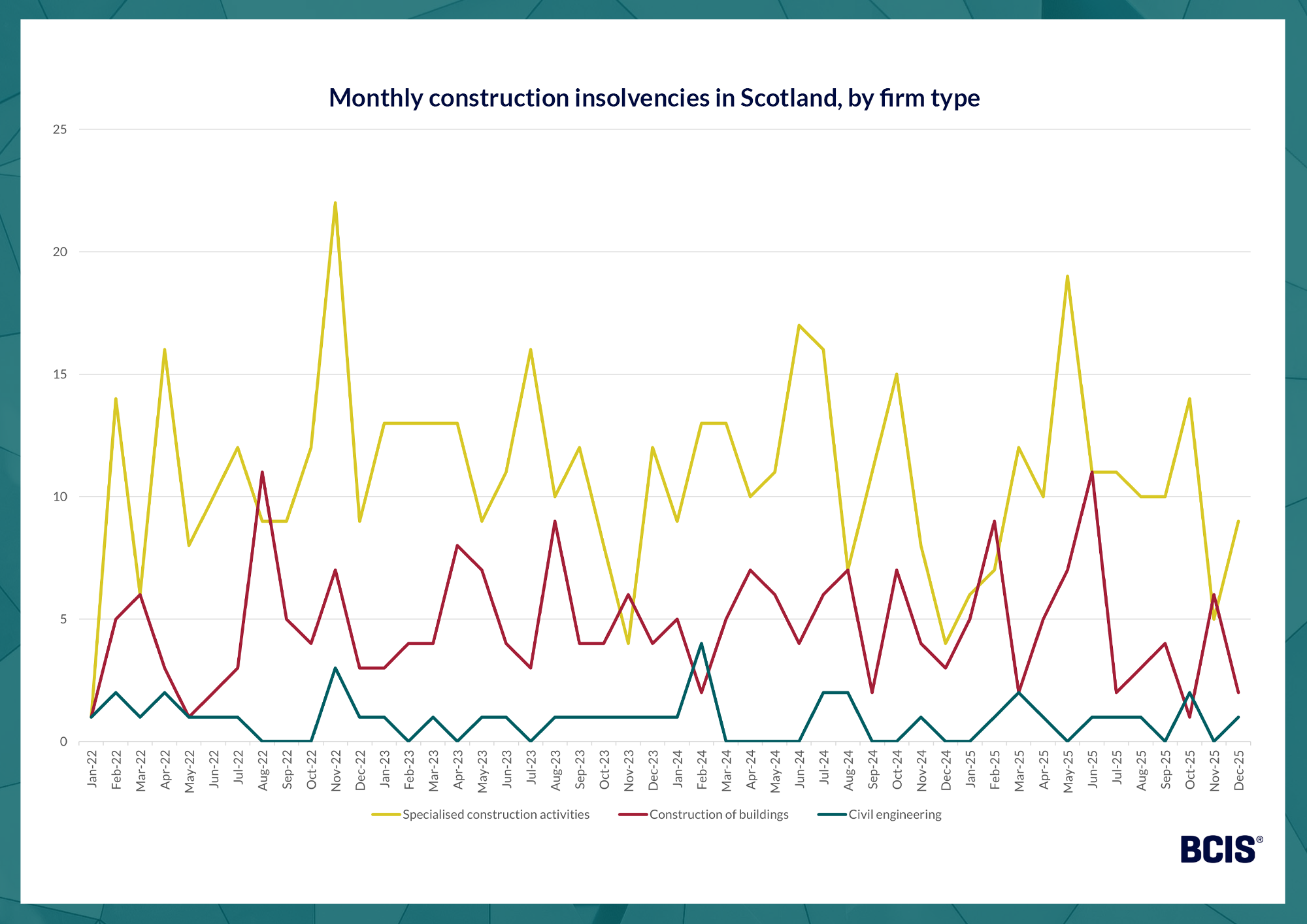

In Scotland, there were 12 construction company insolvencies in December 2025, one more than the 11 recorded in November 2025, and accounting for 10.8% of all insolvencies in the country.

This took the total for the whole of 2025 to 191 – a 5.5% decrease on the 202 recorded in 2024 and a 7.7% fall on the 207 recorded in pre-pandemic 2019.

Source: The Insolvency Service

Within the industry, firms classified as providing specialised construction activities are consistently the most affected across Great Britain. However, analysis shows that their numbers are proportional to their overall share within the construction sector.

This category includes companies providing a range of work, typically on a subcontract basis, from demolition and site preparation to electrical and plumbing installation, and finishing work like plastering, painting and glazing.

The Insolvency Service also publishes figures for Northern Ireland, but not with sector breakdowns.

Analysis by EY-Parthenon(4) on profit warnings issued by listed construction companies has shown particular vulnerabilities in the industry.

It revealed over half of companies in the FTSE household goods and home construction sector issued profit warnings in 2024.

Reflecting on all sectors in 3Q2025, it reported: ‘UK-listed companies issued 64 profit warnings in Q3 2025, slightly above Q2 (59) but well below last year’s peak (84). A steadier number of warnings suggests that many of 2025’s economic and geopolitical pressures are now priced into earnings forecasts, but risks continue to evolve.

‘The broader economic backdrop is still fragile, with restructuring activity increasing as firms face tighter liquidity and reduced flexibility. If this is a pause in profit warnings, it’s an uneasy one.’

According to the report, six profit warnings were issued by FTSE construction and materials companies in 3Q2025, bringing the sector total for 2025 to 14.

Residential market weakness, commercial uncertainty, budget constraints and delays caused by new safety regulations were among the contributing challenges behind the sector’s warnings in 3Q2025.

A multitude of factors feed into company insolvency, though analysis of profit warning data by EY suggests the construction industry is particularly exposed to financial difficulty. This is in part due to the nature of contract cycles and the challenges of cash flow management that contractors and subcontractors are subject to.

Further data(5) released by The Insolvency Service show that 267, or 23%, of self-employed or trader bankruptcies in the 12 months to October 2025 were in construction in England and Wales.

An effective way of mitigating the risks associated with fixed-price contracts when costs are so changeable is to use fluctuation clauses linked to work category and resource-specific inflation indices, such as those available in BCIS CapX.

Our Price Adjustment Formulae Indices (PAFI), covering more than 200 work activities across building, civil engineering, specialist engineering and highways maintenance, can also be used throughout the budgeting and procurement stages to plan cash flow more effectively.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) GOV.UK – Company insolvencies, December 2025 - here

(2) Office for National Statistics – UK business; activity, size and location: 2025 - here

(3) GOV.UK Commentary – Commentary – Company Insolvency Statistics December 2025 - here

(4) EY-Parthenon – Analysis of UK Profit Warnings - here

(5) GOV.UK – Commentary – Individual Insolvency Statistics December 2025 – here