BCIS CapX includes price adjustment formulae, a method of calculating the increase, or decrease, in contractors’ costs over any period. The formulae and indices (over 200 of them) are widely used in various sectors in the construction industry, including civil engineering contracts and facility management.

Published: 20/02/2026

Construction experienced more insolvencies than any other sector in 2025

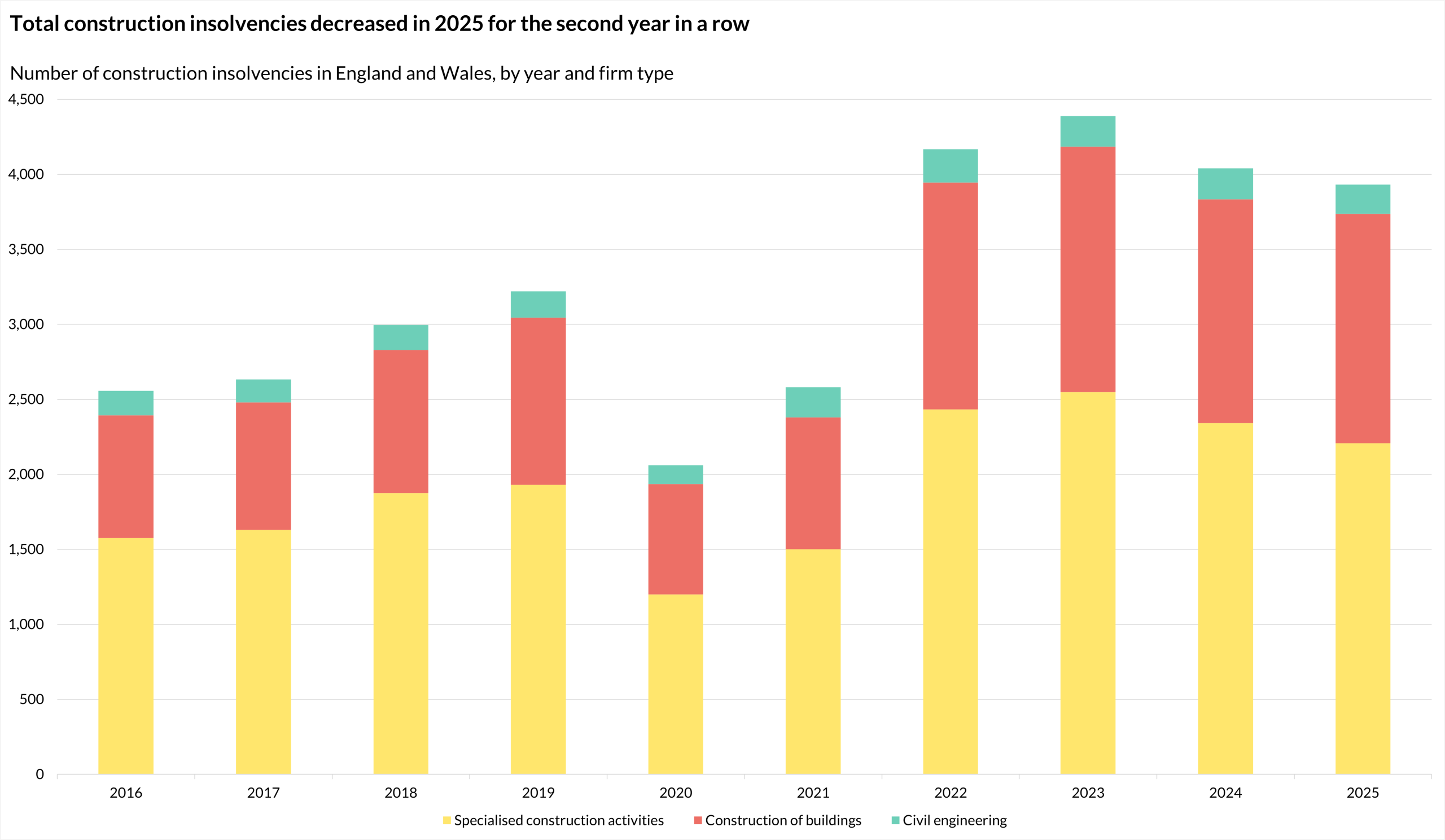

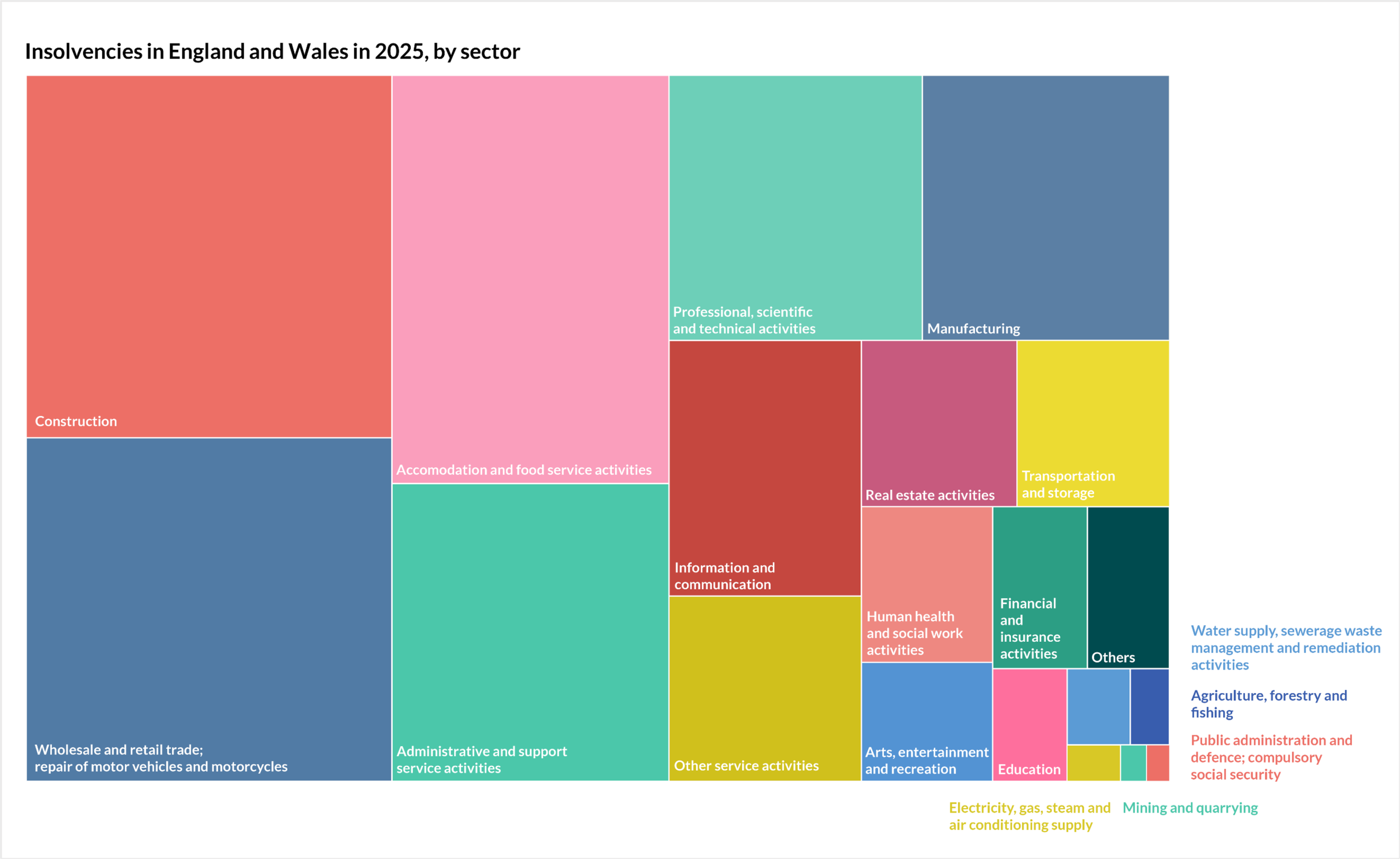

Construction firms accounted for 16.4% of all insolvencies in England and Wales in 2025, representing a larger share than any other sector, according to new data from The Insolvency Service(1).

A total of 3,931 registered construction businesses became insolvent last year.

This was a decrease of 2.7% on the total in 2024 and a rise of 22.0% compared with pre-pandemic 2019.

Source: The Insolvency Service – Company Insolvency Statistics January 2026, Table 1c.

Alongside construction, wholesale and retail trade; repair of motor vehicles and motorcycles and accommodation and food service activities were the only sectors to experience more than 3,000 insolvencies in 2025.

Insolvencies in these sectors represented 15.6% and 14.0% of all insolvencies respectively.

For context, construction firms accounted for 14%(2) of all registered businesses in the UK in 2025.

Source: The Insolvency Service – Company Insolvency Statistics January 2026, Table 1c.

Within construction, the largest proportion of insolvencies were among firms providing specialised construction activities with 2,208 recorded last year.

This was 134 fewer than in 2024 and 277 more than in pre-pandemic 2019.

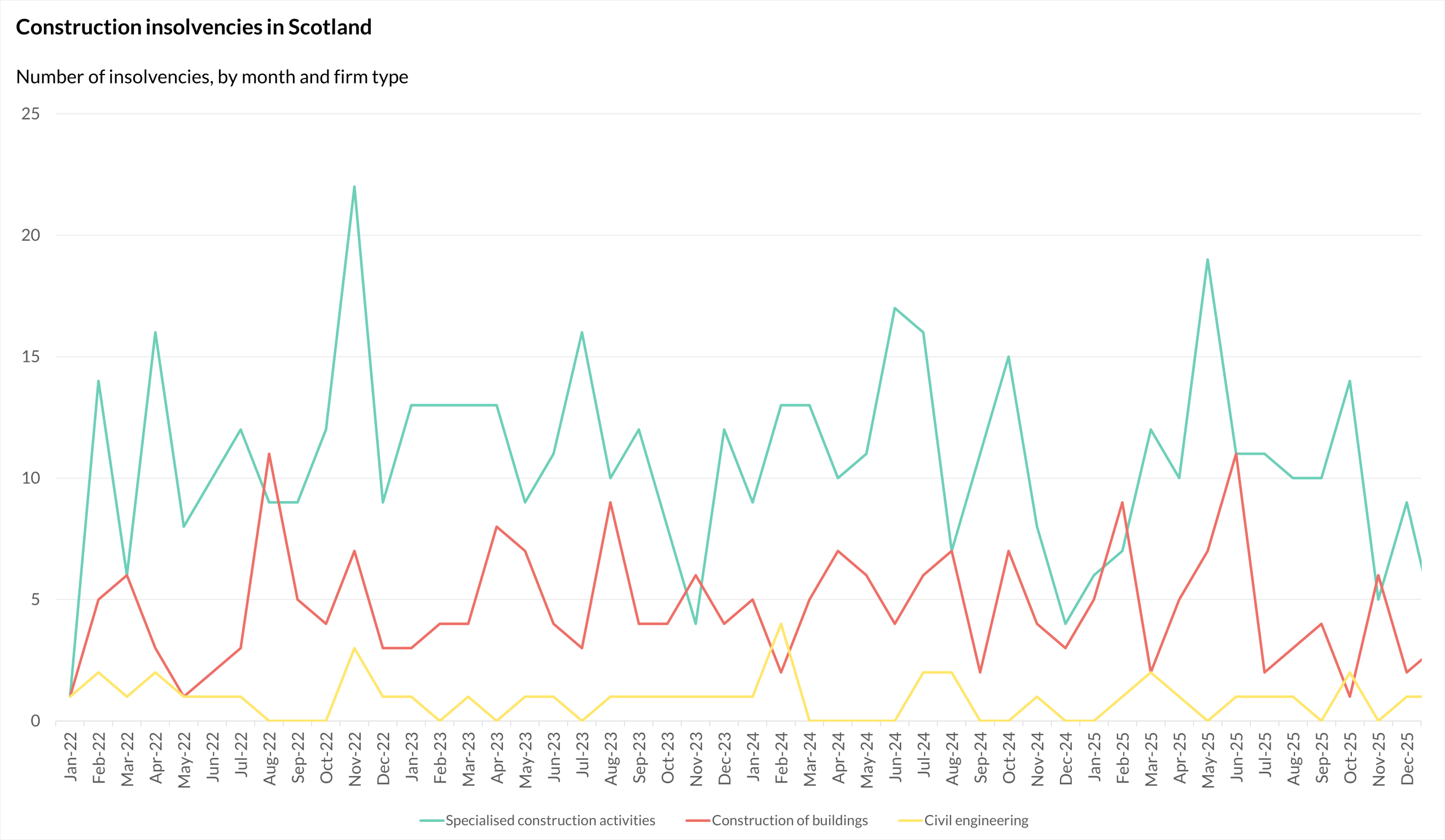

In Scotland, construction firms accounted for 15.0% of all insolvencies in 2025 with 191 registered businesses in the sector becoming insolvent.

This was 11 fewer than the total in 2024 and 16 less than in pre-pandemic 2019.

Again, firms providing specialised construction activities experienced the largest share of insolvencies in the sector with 124 recorded.

Monthly outlook

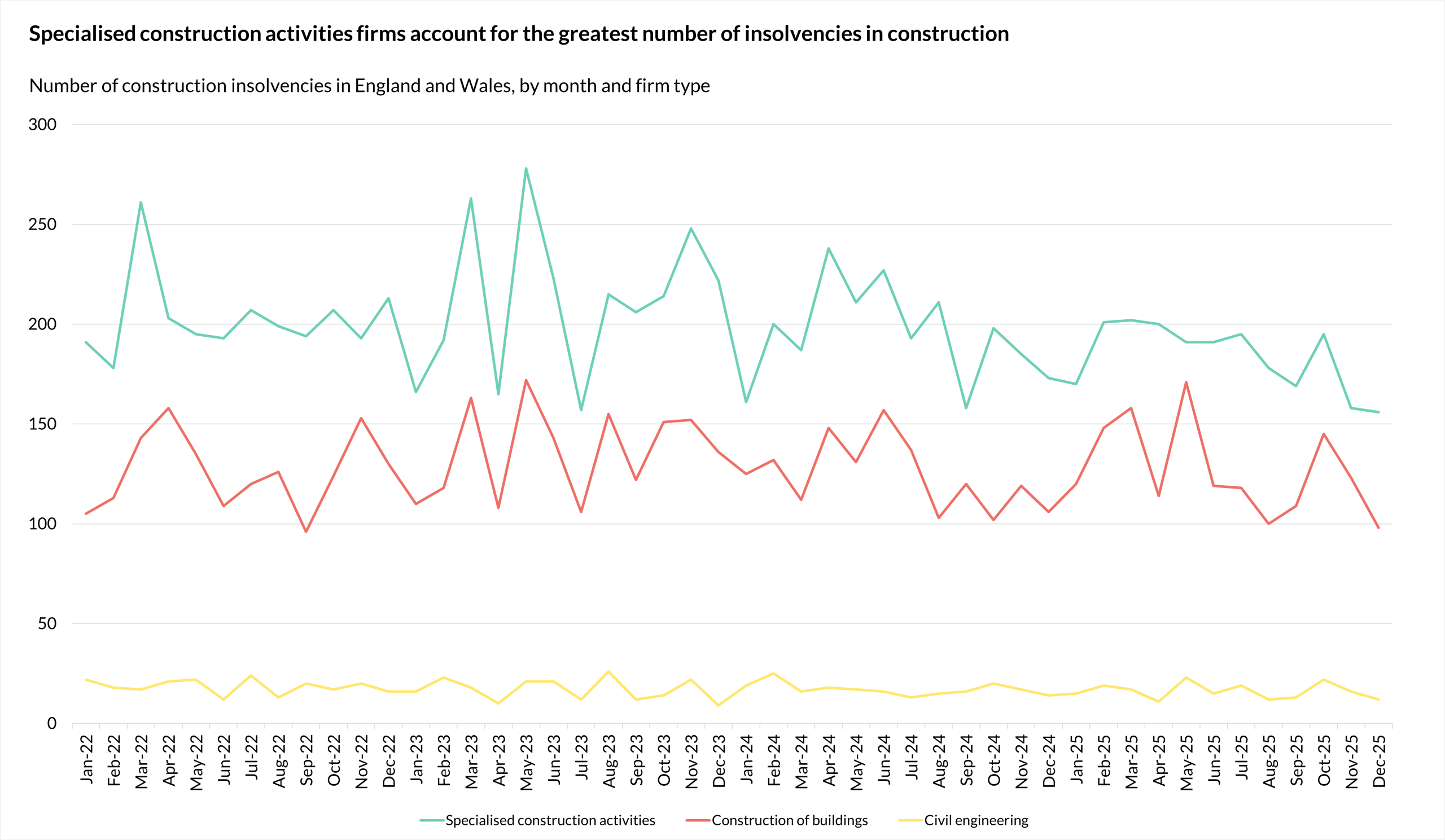

On a monthly basis, 16.6% of all insolvencies in England and Wales in December 2025 were in construction with 266 recorded.

This was the lowest monthly level in the last four years of available data.

Compared with November 2025, insolvencies in December decreased by 34 and by 27 on the year. Firms providing specialised construction activities comprised the largest share of insolvencies with 156 – two fewer than November’s total and 17 less than the amount seen in December 2024.

Source: The Insolvency Service – Company Insolvency Statistics January 2026, Table 1c.

The Insolvency Service said that while the insolvency rate has increased since the lows seen in 2020 and 2021, it remains much lower than the peak of 113.1 per 10,000 companies seen during the 2008-09 recession. This is because the number of companies on the effective register has more than doubled over this period. The rate in the year to the end of January 2026 was 51.7 per 10,000 companies(3).

In Scotland, there were eight construction company insolvencies in January 2026, four less than the 12 recorded in December 2025 and accounting for 10.8% of all insolvencies in the country.

Source: The Insolvency Service – Company Insolvency Statistics January 2026, Table 4b.

Within the industry, firms classified as providing specialised construction activities are consistently the most affected across Great Britain. However, analysis shows that their numbers are proportional to their overall share within the construction sector.

This category includes companies providing a range of work, typically on a subcontract basis, from demolition and site preparation to electrical and plumbing installation, and finishing work like plastering, painting and glazing.

The Insolvency Service also publishes figures for Northern Ireland, but not with sector breakdowns.

Analysis by EY-Parthenon(4) on profit warnings issued by listed construction companies has shown particular vulnerabilities in the industry.

In 2025, profit warnings issued by FTSE Construction and Materials firms in the UK were more than triple the number issued in 2024.

Over half of these cited weaker confidence, delays in contract starts or slippage in project timelines. Labour shortages, legacy liabilities, rising employment costs and increasing regulatory complexity were also highlighted as sources of disruption and pressure in the report.

Looking forward, EY-Parthenon’s summary said: ‘In 2026 stress is still broad-based. Many retailers are weighed down by rising costs, weak sentiment and increasing investment needs. Meanwhile, sectors such as chemicals and construction continue to struggle with high input costs, regulatory pressures and fragile demand.

‘Healthcare providers report intensifying cost and spending pressures. As a result, confidence remains fragile and risks continue to evolve, and we expect restructuring pressures to continue to build in the year ahead.’

A multitude of factors feed into company insolvency, though analysis of profit warning data by EY suggests the construction industry is particularly exposed to financial difficulty.

This is in part due to the nature of contract cycles and the challenges of cash flow management that contractors and subcontractors are subject to.

Further data(5) released by The Insolvency Service show that 267, or 23%, of self-employed or trader bankruptcies in the 12 months to October 2025 were in construction in England and Wales. Data covering later periods are not currently available due to The Insolvency Service moving to a new case management system in November 2025.

An effective way of mitigating the risks associated with fixed-price contracts when costs are so changeable is to use fluctuation clauses linked to work category and resource-specific inflation indices, such as those available in BCIS CapX.

Our Price Adjustment Formulae Indices (PAFI), covering more than 200 work activities across building, civil engineering, specialist engineering and highways maintenance, can also be used throughout the budgeting and procurement stages to plan cash flow more effectively.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) GOV.UK – Company insolvencies, January 2026 – here

(2) Office for National Statistics – UK business; activity, size and location: 2025 - here

(3) GOV.UK Commentary – Commentary – Company Insolvency Statistics January 2026 - here

(4) EY-Parthenon – Analysis of UK Profit Warnings - here

(5) GOV.UK – Commentary – Individual Insolvency Statistics January 2026- here