If you are a housebuilder or developer, please fill in the survey. If you have any questions or would like to discuss the survey, please call +44 0330 341 1000 or email contactbcis@bcis.co.uk

Published: 20/08/2025

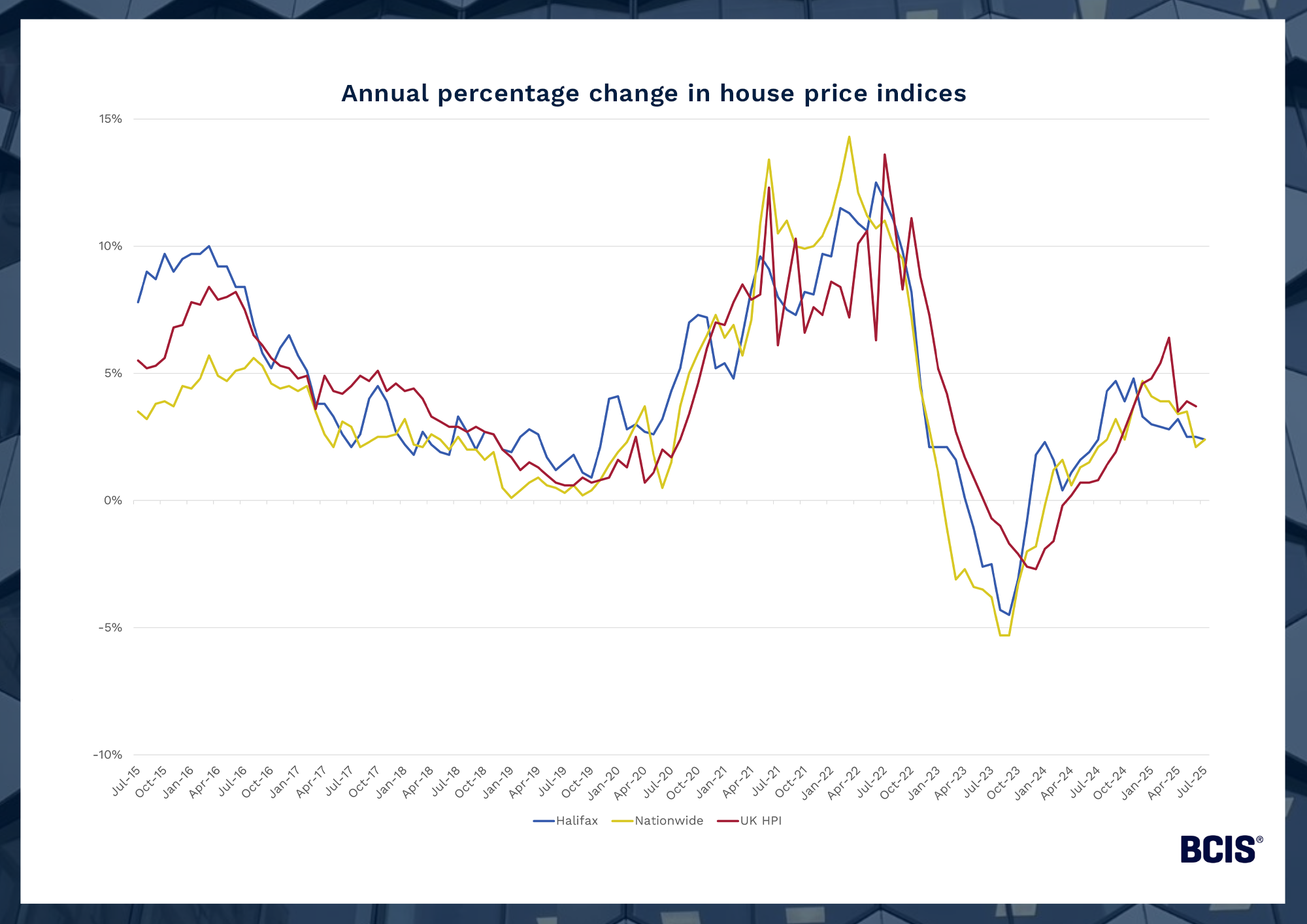

Each month, Halifax, Nationwide and HM Land Registry publish house price indices, tracking the movement in average house prices in the UK. Halifax and Nationwide updates are based on mortgage approvals data, while the UK HPI is a joint production by HM Land Registry, Land and Property Services Northern Ireland, ONS and Registers of Scotland.

House price indices show continued growth

House prices grew in the year to July 2025, according to Halifax(1) and Nationwide’s(2) indices.

Both reported a 2.4% annual increase in house prices.

In the same 12-month period ending in July 2025, the Consumer Prices Index (CPI), which measures the average change in prices paid by consumers for goods and services, rose by 3.8%(3). This was up from 3.6% in the 12 months to the end of June 2025.

Dr David Crosthwaite, chief economist at BCIS, said: ‘Once again, house price growth was behind wider economy inflation in July. The CPI was higher than expected and continues to rise which is a concern for the housing market.

‘Housing affordability had appeared relatively healthy in recent years, due to falling interest rates, but the continued presence of inflation may stall decision-making among buyers.’

On a monthly basis, Halifax said prices increased by 0.4% on June 2025, while Nationwide’s index showed a 0.6% rise.

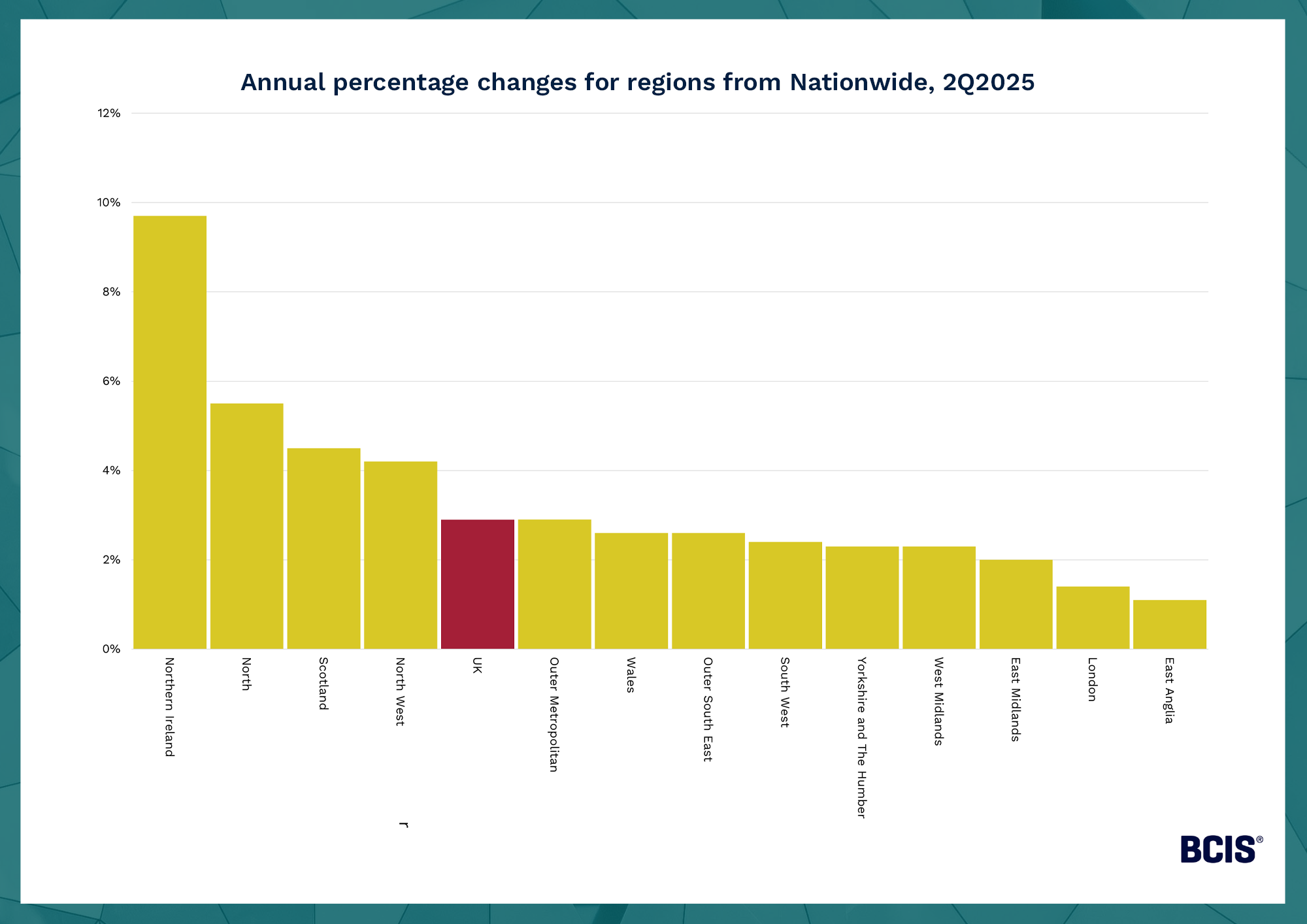

Amanda Bryden, Head of Mortgages at Halifax, said that while the national average remains high, house prices vary across the UK.

Looking ahead, she said: ‘Challenges remain for those looking to move up or onto the property ladder. But with mortgage rates continuing to ease and wages still rising, the picture on affordability is gradually improving.

‘Combined with the more flexible affordability assessments now in place, the result is a housing market that continues to show resilience, with activity levels holding up well.’

Nationwide’s Chief Economist, Robert Gardner, remarked that housing affordability has been steadily improving due to a period of strong economic growth, a modest fall back in mortgage rates and more subdued house price growth.

He added: ‘While the price of a typical UK home is around 5.75 times average income, this ratio is well below the all-time high of 6.9 recorded in 2022 and is currently the lowest this ratio has been for over a decade. This is helping to ease deposit constraints for potential buyers, as has an improvement in the availability of higher loan to value mortgages.’

The UK HPI(4), with the latest data for June 2025, showed a 3.7% increase in house prices compared with June 2024, with a 1.4% increase on May 2025.

As the UK HPI figures cover house sales that may have been agreed in months previously, there tends to be a lag in the data.

Source: Halifax (Methodology), Nationwide (Methodology), UK HPI (Methodology)

The latest regional data from Nationwide shows Northern Ireland, the North and Scotland saw the greatest annual increases in 2Q2025. There was a 9.7% rise in house prices in Northern Ireland, down from 13.5% in 1Q2025. East Anglia showed the lowest annual increase, with 1.1% growth in the same period.

Source: Nationwide

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.