If you are a housebuilder or developer, please fill in the survey. If you have any questions or would like to discuss the survey, please call +44 0330 341 1000 or email contactbcis@bcis.co.uk

Published: 21/01/2026

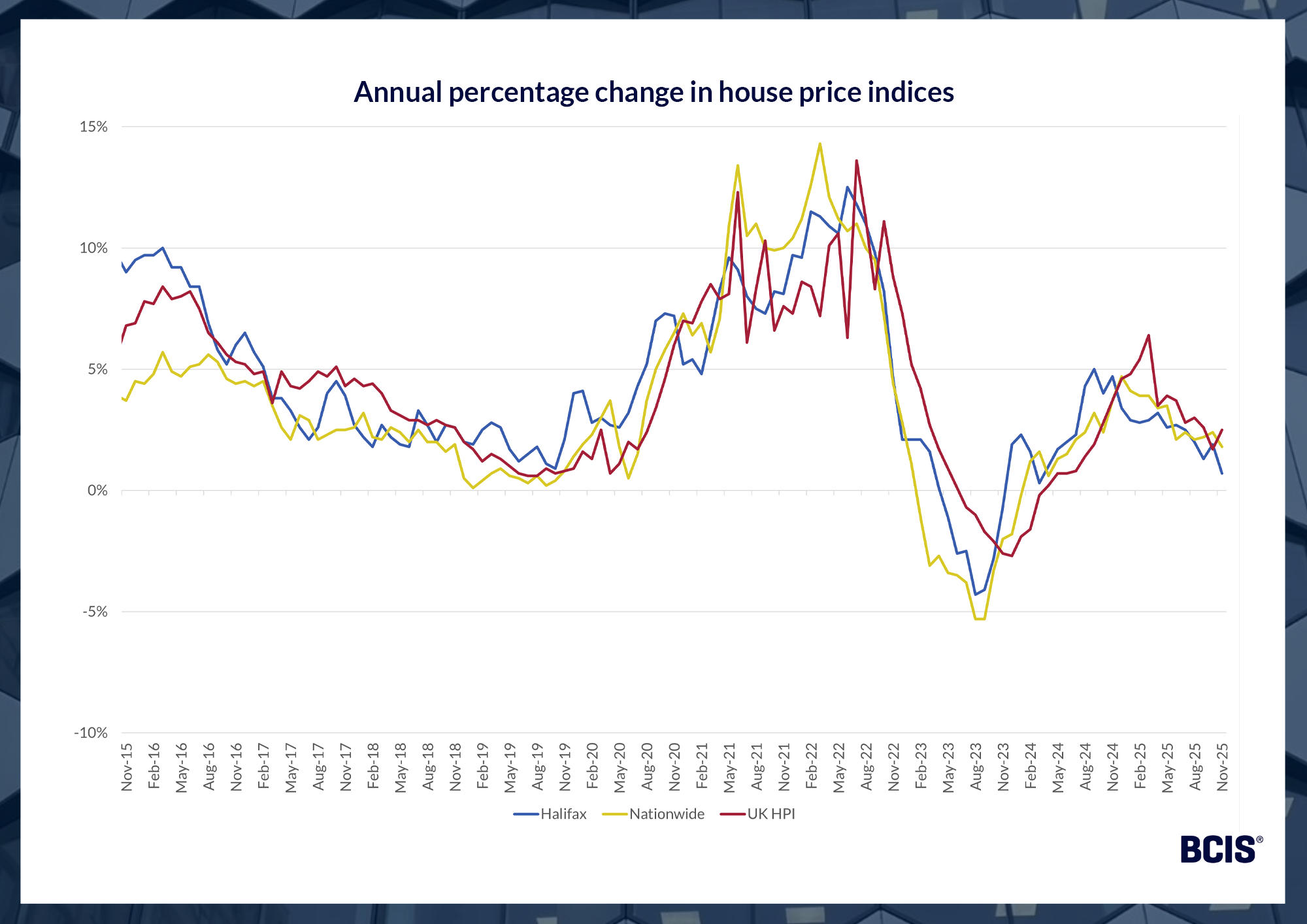

Each month, Halifax, Nationwide and HM Land Registry publish house price indices, tracking the movement in average house prices in the UK. Halifax and Nationwide updates are based on mortgage approvals data, while the UK HPI is a joint production by HM Land Registry, Land and Property Services Northern Ireland, ONS and Registers of Scotland.

Annual house price growth slows at year’s end

House prices rose in the year to December 2025, according to Halifax(1) and Nationwide’s(2) indices.

Halifax reported a 0.3% annual increase in house prices, while Nationwide’s index showed a rise of 0.6% in the same period.

On a monthly basis, both Halifax and Nationwide reported a decrease in prices in December, by 0.6% and 0.4% respectively.

Dr David Crosthwaite, chief economist at BCIS, said: ‘Despite the lethargic movement of house prices in December, the market held steady last year. Pending a continued easing of high interest rates and uncertainty, and return to lower levels of inflation after a small rise in December, buyer borrowing power should improve in the months to come. This is good news for construction’s residential market where weaker demand has been holding back output.’

According to the latest insight from the Financial Conduct Authority, which collects mortgage lending data via the Mortgage Lending and Administration Return(3), the value of new mortgage commitments (lending agreed to be advanced in the coming months) increased by 1.6% in 3Q2025 from the previous quarter – the highest since 3Q2022 and 20.3% higher than one year earlier.

Amanda Bryden, Head of Mortgages at Halifax, said that while the latest movement may feel like a subdued close to the housing market in 2025, activity levels remained resilient and in line with the pre-pandemic average.

She added: ‘Various forces are poised to somewhat buoy the market heading into 2026. While December’s monthly fall in prices was likely related to uncertainty in the latter part of the year, this should now be starting to unwind.

‘Further, mortgage rates are already reducing following the latest Base Rate cut and there are an increasing number of lending options available for those borrowing at a higher loan-to-value.’

Nationwide’s Chief Economist, Robert Gardner, said annual price growth in Nationwide’s index between November and December moved at the slowest pace since April 2024.

Reflecting on 2025, he added: ‘Despite the softer end to the year, the word that best describes the housing market in 2025 overall is resilient. Even though consumer sentiment was relatively subdued, with households reluctant to spend and mortgage rates around three times their post-pandemic lows, mortgage approvals remained near pre-Covid levels.’

The UK HPI(4), with the latest data for November 2025, showed a 2.5% increase in house prices compared with November 2024, with a 0.3% increase on October 2025.

As the UK HPI figures cover house sales that may have been agreed in months previously, there tends to be a lag in the data.

Source: Halifax (Methodology), Nationwide (Methodology), UK HPI (Methodology)

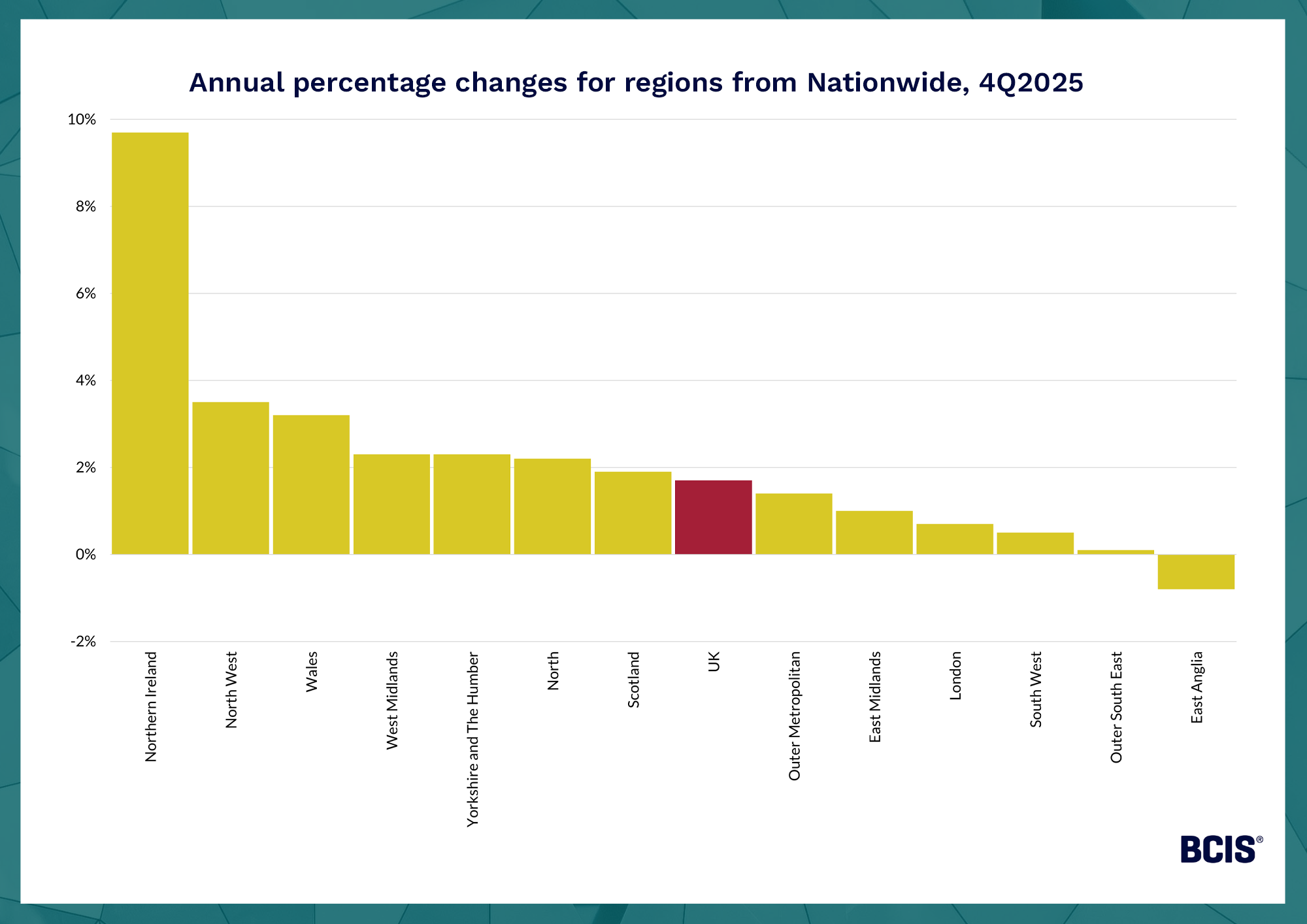

The latest regional data from Nationwide show Northern Ireland and the North West saw the greatest annual house price increases in 4Q2025, by 9.7% and 3.5% respectively.

East Anglia was the only region to experience a fall of 0.8% on an annual basis.

In 4Q2025, the UK as a whole saw annual price growth of 1.7% on the same quarter in 2024.

Source: Nationwide

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.