The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 22/08/2025

Each month HM Treasury publishes a comparison of independent forecasts for the UK economy, including averages for GDP growth and Consumer Prices Index (CPI) inflation. These forecasts are a useful barometer for construction, helping firms to understand the wider forces shaping demand, costs and investment decisions.

Slight firming in near-term growth predictions

Independent economic forecasts published by HM Treasury in August show a slightly firmer near-term growth picture, but reinforce the subdued outlook for construction activity over the coming year(1).

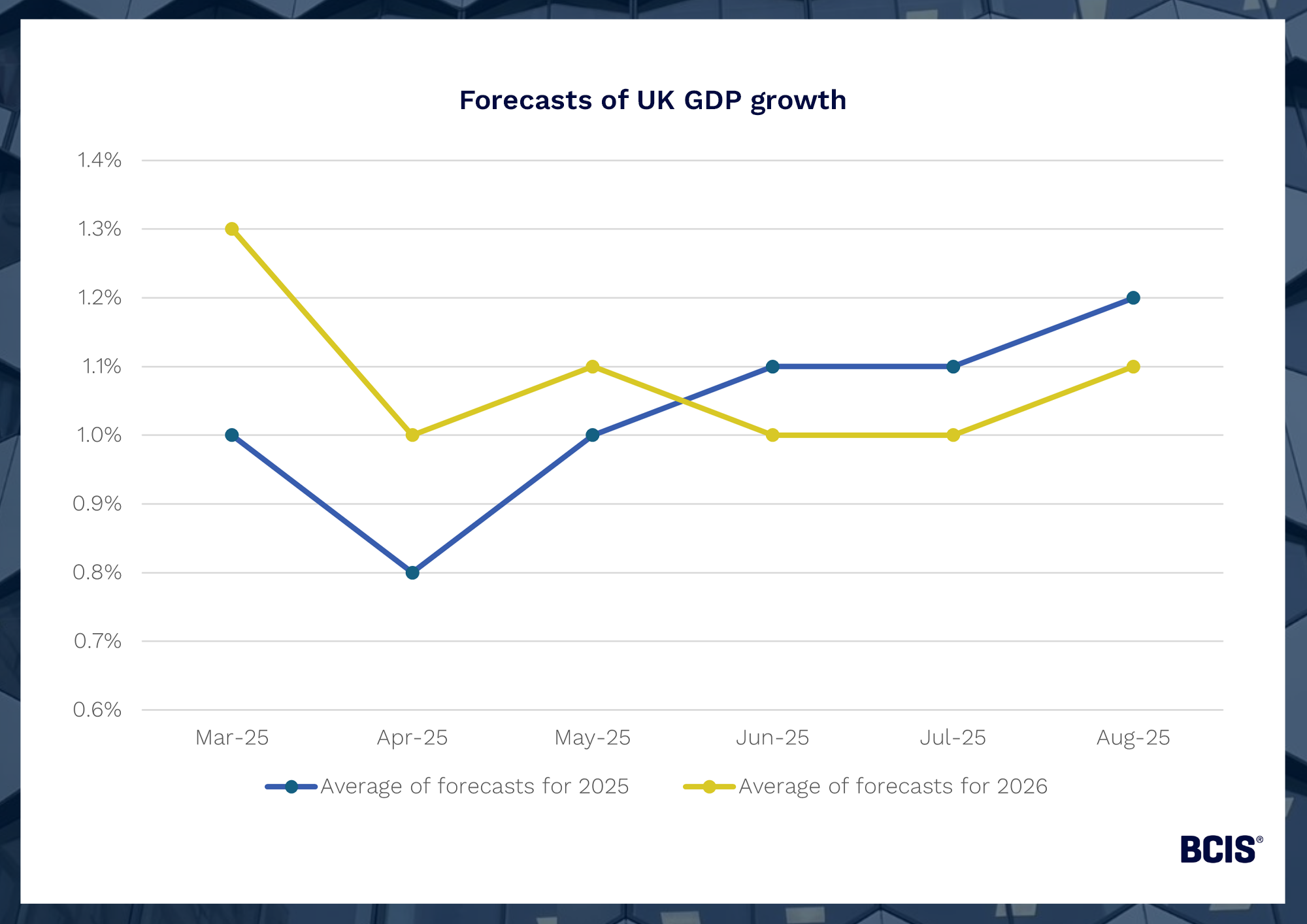

The average of independent forecasts points to UK GDP growth of just 1.2% in 2025, moderating to 1.1% in 2026.

This is a slight improvement on the 1.1% and 1.0% average forecasts published for 2025 and 2026 respectively last month. By comparison, GDP averaged closer to 2% growth through most of the 2010s. Since the pandemic, growth has settled at closer to 1% per year, reflecting the UK’s weaker post-COVID recovery.

Source: HM Treasury

The latest ONS estimates show GDP grew by 0.4% in June 2025, following a fall of 0.1% in May 2025 and a fall of 0.1% in April 2025(2). Within that, construction output grew by 0.3% in June 2025, following a fall of 0.5% in May 2025 and growth of 0.9% in April 2025.

Dr David Crosthwaite, chief economist at BCIS, said: ‘The latest forecasts are a clear reminder that we remain in a low-growth environment and construction cannot rely on growth in the wider economy to generate demand in the way it did through much of the last decade. That has big implications for how firms plan pipeline, capacity and investment decisions.’

A flat economic backdrop means housebuilders, developers and clients are unlikely to ramp up investment quickly. For construction firms, this suggests any rebound in workload will be gradual and could be uneven.

Inflationary pressures remain

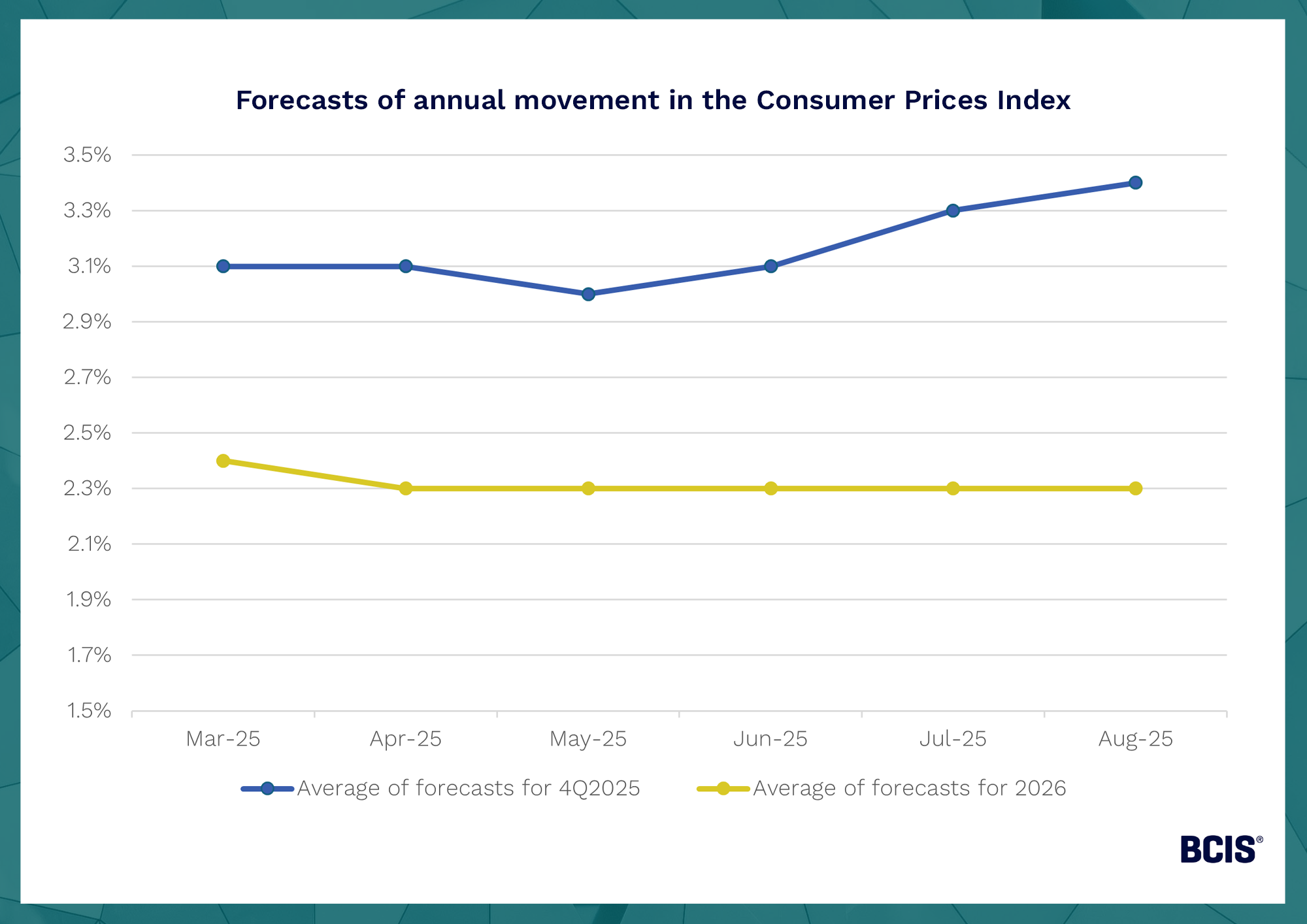

Forecasts suggest CPI inflation will average 3.4% in 4Q2025, compared with 4Q2024, easing to 2.3% throughout 2026.

While the 2026 outlook is unchanged since April, expectations for 4Q2025 have increased slightly from 3.3% last month.

Source: HM Treasury

Dr Crosthwaite added: ‘Inflation returning closer to the Bank of England’s target will help when it materialises, but the persistence of price rises well above 2% means cost pressures remain. For construction, this implies materials and labour costs are likely to continue rising in real terms, tender price inflation may prove sticky as contractors price in uncertainty, and clients face continued tension between budgets and delivery costs, particularly on long-duration projects.’

He also warned that tight financing conditions could mean developers hold back on speculative projects.

‘Stagnant GDP growth limits fiscal headroom, raising questions over how the government funds infrastructure ambitions,’ he said. ‘All eyes now turn to the Autumn Budget. The Chancellor’s choices could make the difference between stalled momentum and renewed confidence for construction.’

To keep up to date with the latest industry news and insights from BCIS register for our newsletter here.